For those seeking reliable protection for their vehicles, residences, and additional liability, combining policies can lead to significant savings and convenience. This article outlines various options available, comparing features, costs, and benefits to help you make informed choices.

Individuals and families looking for comprehensive coverage will find valuable insights here. Whether you’re a first-time buyer or reassessing your current plans, understanding your options is crucial. We will explore key aspects of different packages, including discounts for bundling, policy limits, and customer service ratings.

This guide provides a clear examination of leading providers and their offerings, along with practical tips for selecting the right plan. By the end, you’ll have a better grasp of how to secure the appropriate level of protection tailored to your specific situation.

Choosing Coverage for Combined Vehicle, Residence, and Liability Protection

Prioritize finding a provider that offers significant discounts for combining different types of coverage. This approach not only simplifies management but also enhances overall protection. Look for options that allow seamless integration of vehicle, dwelling, and additional liability coverage under one plan.

Evaluate the financial stability and customer service reputation of potential providers. Research online reviews and ratings to gauge the experiences of other policyholders. Ensure that the company has a strong track record in handling claims efficiently and effectively.

Key Factors to Consider

- Discounts: Many companies provide savings for combining policies. Inquire about specific percentages and any additional perks.

- Coverage Limits: Assess whether the limits offered meet personal requirements. It’s vital to have adequate coverage to protect against potential losses.

- Claims Process: Review the claims process to ensure it is straightforward. A company with a user-friendly claims system can save time and reduce stress during challenging situations.

- Customer Support: Look for a provider with accessible customer service. Reliable support can make a significant difference when assistance is needed.

Consider consulting with an independent agent who can provide tailored recommendations based on individual needs. An expert can help navigate the various options available and identify the most suitable arrangements.

Finally, remember to reassess your coverage periodically, especially after significant life changes, such as moving or acquiring new assets. This ensures that your protection remains aligned with current circumstances.

Evaluating Coverage Options for Auto and Home Insurance

Assessing coverage choices requires careful examination of your needs and potential risks. Begin by determining the value of your personal property and vehicles, as well as the level of liability protection you desire. This evaluation ensures that you select a plan that adequately protects your assets while remaining economical.

Next, consider the types of incidents that could arise in daily life. Common risks include accidents, theft, and natural disasters. Each policy will offer different protections, so understanding the specifics of what is included, such as replacement cost versus actual cash value, is essential.

Key Factors to Examine

- Coverage Limits: Analyze the maximum amount your policy will pay in the event of a claim. Ensure these limits are sufficient to cover the full value of your possessions and potential liabilities.

- Deductibles: Determine the amount you will need to pay out of pocket before your coverage kicks in. Higher deductibles often result in lower premiums but can significantly affect your financial burden during a claim.

- Exclusions: Review what incidents are not covered by your policy. Understanding these exclusions helps avoid surprises when filing a claim.

- Discounts: Investigate available discounts for bundling policies, maintaining a good driving record, or installing security systems. These can lower your overall costs.

Consulting with an agent can clarify any uncertainties and provide tailored recommendations based on individual circumstances. Regularly reviewing and adjusting your coverage in response to life changes, such as home renovations or acquiring new vehicles, ensures that you remain adequately protected.

Key Benefits of Combining Policies for Maximum Savings

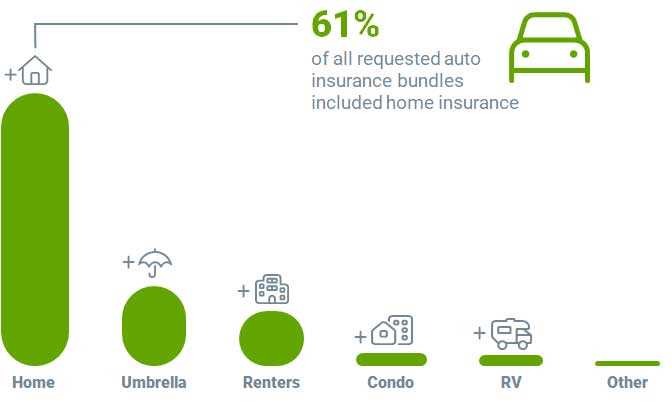

Combining different coverage options can lead to significant financial advantages. Many providers offer discounts for clients who choose to purchase multiple types of protection. This approach not only lowers premiums but also simplifies management by consolidating multiple policies into a single account.

One of the primary benefits is the potential for reduced costs. By bundling, clients often qualify for lower rates compared to purchasing each type of coverage separately. These savings can accumulate over time, resulting in substantial annual reductions.

Additional Advantages of Policy Combination

- Simplified Payments: Managing one payment can reduce confusion and the risk of missed due dates. This streamlining helps maintain continuous coverage without the hassle of tracking multiple bills.

- Unified Coverage Limits: Having a cohesive strategy allows for better alignment of coverage limits across various types of protection, ensuring comprehensive safeguarding against potential risks.

- Enhanced Customer Service: Clients often experience improved service quality when dealing with a single provider, including personalized assistance and quicker claims processing.

- Tailored Protection: Combining policies allows for customization to better fit personal needs, ensuring adequate coverage where it’s needed most.

In summary, merging different types of protection can lead to considerable savings while enhancing coverage and simplifying management. Clients should explore options with their providers to maximize these benefits and ensure they receive the most value from their investment.

Understanding Umbrella Coverage and Its Importance

Having a supplemental layer of protection can be a wise decision for many individuals and families. This additional coverage extends beyond standard policies, providing extra security against significant claims that may exceed the limits of your primary plans.

In scenarios where liability claims arise, such as accidents or damages that lead to legal action, this type of coverage serves as a financial safeguard. It can cover legal fees, medical expenses, and damages, ensuring that you are not left vulnerable to substantial financial loss.

Key Benefits of Additional Coverage

Here are some critical advantages to consider:

- Increased Liability Limits: This type of plan typically offers higher coverage limits than standard policies, which can be essential in severe incidents.

- Broad Coverage Scope: It can address various scenarios, from personal injury to property damage, extending beyond the typical limits.

- Peace of Mind: Knowing you have extra protection can alleviate stress regarding potential financial repercussions from unforeseen events.

Investing in this additional layer can be especially beneficial for those with significant assets to protect. It acts as a financial buffer, ensuring that personal savings and investments remain secure in the face of unexpected legal challenges.

In conclusion, understanding the function and value of this supplementary coverage can lead to more informed decisions regarding personal financial security. Considering the potential for high costs in liability claims, securing this protection can be a prudent step for safeguarding your future.

Top Providers Offering Comprehensive Bundled Coverage Plans

Geico stands out with its competitive pricing and user-friendly online platform, making it a popular choice for families seeking multi-policy options. Their bundling discounts can lead to significant savings while providing broad coverage across various needs.

State Farm offers a versatile selection of packages that seamlessly integrate various types of protection. With a robust network of agents, customers can receive personalized service and tailored solutions that suit their specific situations.

Provider Comparison

| Provider | Key Features | Discounts Available |

|---|---|---|

| Geico | User-friendly platform, extensive coverage options | Multi-policy, safe driver |

| State Farm | Personalized service, strong local agents | Bundling, loyalty |

| Progressive | Customizable plans, online quotes | Multi-policy, online sign-up |

| Allstate | Comprehensive coverage, strong customer service | Bundling, safe driving |

Consider these options based on your unique circumstances. Each provider offers distinct features and discounts, ensuring that customers can find a plan that fits their requirements and budget. Evaluate your priorities and choose the company that aligns best with your protection needs.

Best insurance for bundles of auto home and umbrella

Video:

FAQ:

What are the benefits of bundling auto, home, and umbrella insurance?

Bundling auto, home, and umbrella insurance can lead to significant savings on premiums, as many insurance companies offer discounts for customers who choose to combine their policies. Additionally, having all your insurance needs under one provider simplifies management, making it easier to track payments and policy details. Bundled policies often come with more comprehensive coverage options, which can provide better protection for your assets. This can also enhance your peace of mind, knowing that you have a cohesive insurance strategy in place.

How does the umbrella insurance policy work with auto and home insurance?

An umbrella insurance policy provides additional liability coverage that goes beyond the limits of your auto and home insurance. For example, if you face a lawsuit due to an accident where you are at fault, your auto insurance may cover damages up to a certain limit. If costs exceed that limit, umbrella insurance can help cover the remaining expenses. This type of policy is particularly valuable for individuals with significant assets to protect, as it can safeguard against large claims that could otherwise jeopardize financial stability.

Are there specific providers known for offering competitive bundle packages for auto, home, and umbrella insurance?

Many major insurance companies are recognized for offering competitive bundle packages, including State Farm, Allstate, Geico, and Progressive. Each provider has its own unique pricing structure and discount offerings, so it’s beneficial to compare quotes from several companies to find the best deal. Additionally, local or regional insurers may also provide attractive bundle options that cater to specific community needs. Always check the coverage details and customer reviews to ensure you are selecting a reliable provider.

What factors should I consider before purchasing a bundled insurance policy?

Before purchasing a bundled insurance policy, consider factors such as your coverage needs, the limits of each policy, and any exclusions that may apply. Assess your assets and determine how much liability coverage you may need, especially with an umbrella policy. Additionally, evaluate the financial stability and customer service reputation of the insurance provider. It is also wise to review the discounts available for bundling and to compare them with separate policies to identify any potential savings.