To ensure robust protection for your S corporation, consider exploring various avenues for additional liability coverage. This article outlines effective strategies and resources to help you identify reliable options tailored to your business’s unique needs.

You’ll discover insights into reputable providers, the types of protection available, and key factors to evaluate when selecting a plan. Whether you are a seasoned business owner or just starting, this guide will equip you with the knowledge necessary to make informed decisions.

By reviewing the recommendations provided, you can enhance your organization’s risk management strategy and safeguard against unforeseen incidents. Take the time to assess your requirements and leverage the information presented here for optimal outcomes.

Finding Umbrella Coverage Solutions for S Corporations

Exploring options for additional liability coverage is essential for S Corporations. One effective method is to consult with specialized insurance brokers who focus on commercial policies. These professionals can provide tailored advice and present multiple options based on specific business needs.

Another approach involves researching online platforms that aggregate quotes from various providers. These sites allow business owners to compare coverage limits, premiums, and policy features side by side, facilitating informed decision-making.

Considerations for Selecting Coverage

When evaluating potential providers, focus on the following factors:

- Reputation: Research customer reviews and industry ratings to gauge the reliability of the insurance company.

- Policy Flexibility: Look for options that allow customization of coverage limits and endorsements.

- Claims Process: Investigate the efficiency of the claims handling process and the support available during claims submission.

Additionally, networking with other S Corporations can yield valuable recommendations. Engaging in industry associations or local business groups may provide insights into experiences others have had with different providers.

Lastly, it may be beneficial to consult a financial advisor or legal expert who specializes in corporate matters. Their expertise can guide S Corporations in understanding the implications of various coverage types on overall business risk management.

Online Insurance Marketplaces for S Corporations

For S corporations seeking additional liability protection, exploring various digital platforms can yield beneficial options. These marketplaces provide a streamlined experience, allowing businesses to compare multiple policies side by side.

Using these online resources, S corporations can easily assess quotes from various providers, making the selection process more straightforward. Many of these platforms offer user-friendly interfaces that simplify the collection of necessary information, enhancing efficiency.

Key Features of Online Marketplaces

- Comparative Analysis: Users can evaluate different policies based on coverage limits, premiums, and deductibles.

- Customizable Options: Many platforms allow tailoring coverage to specific business needs, ensuring adequate protection.

- Customer Reviews: Access to feedback from other business owners can guide informed decision-making.

- Expert Assistance: Some sites offer consultations with licensed agents who can clarify complex terms.

Utilizing these online tools can lead to informed decisions and potentially significant savings on overall coverage costs. Always ensure to read the fine print before finalizing any agreement.

Local Insurance Agents Specializing in Umbrella Coverage

Choosing a local agent who focuses on additional liability protection can significantly ease the process of obtaining the right policy. These professionals possess a wealth of knowledge about the unique risks associated with businesses in your area, allowing for tailored solutions. Their familiarity with local laws and regulations enhances their ability to provide relevant advice and competitive options.

Engaging with agents who specialize in extended liability options fosters a more personal experience. They can assess specific needs and recommend appropriate coverage limits based on your business operations and potential exposure to risks. This personalized approach often results in better protection and peace of mind.

Benefits of Local Agents

- Accessibility: Local agents are readily available for consultations, making communication easier and more efficient.

- Tailored Solutions: They understand the local market and can offer customized plans that reflect the realities of your business environment.

- Personalized Service: Building a relationship with an agent can lead to better service and support when claims arise.

When selecting an agent, consider the following factors:

- Experience: Look for agents with a proven track record in handling additional liability options.

- Reputation: Research client reviews and testimonials to gauge their reliability.

- Network: A well-connected agent can provide access to multiple carriers, enhancing your options.

In conclusion, working with local specialists in supplementary liability coverage can offer substantial advantages. Their deep understanding of the regional market and commitment to personalized service ensure that your business is adequately protected against unforeseen circumstances.

Industry-Specific Associations Offering Insurance Resources

Many industry-specific associations provide valuable resources related to liability protections. Engaging with these organizations can facilitate connections to trusted providers and tailored coverage options that meet unique needs.

Associations often develop relationships with insurers who understand specific risks associated with particular sectors. This enables members to access competitive rates and specialized policies that standard providers might not offer.

Benefits of Consulting Industry Associations

- Networking Opportunities: Members can connect with peers and share experiences regarding coverage options.

- Educational Resources: Many associations offer workshops and materials to help members understand their coverage needs.

- Advocacy: Associations often advocate for favorable regulations and practices that can benefit their members.

Consider reaching out to relevant associations within your field to explore their resources and recommendations. Engaging with these organizations can lead to informed decisions regarding liability protections that align with your business objectives.

Comparative Analysis of Major Insurance Providers

Evaluating various companies that offer additional liability coverage reveals significant differences in policy features, pricing, and customer service. When assessing these options, it’s important to consider specific needs and potential risks associated with business operations. This analysis highlights key attributes of selected providers that can influence decision-making.

One primary factor to examine is the extent of coverage offered. Different providers vary in terms of limits on liability and the range of incidents covered. Additionally, the cost structure can be a deciding element. Some organizations may offer lower premiums but with higher deductibles or more exclusions, while others might provide broader coverage at a premium price.

Key Attributes Comparison

| Provider | Coverage Limits | Premium Range | Customer Service Rating |

|---|---|---|---|

| Provider A | $1 million – $5 million | $300 – $1,200 annually | 4.5/5 |

| Provider B | $1 million – $10 million | $400 – $1,500 annually | 4.0/5 |

| Provider C | $2 million – $5 million | $350 – $1,100 annually | 4.8/5 |

In addition to coverage and pricing, evaluating customer service is essential. A provider with a strong reputation for responsiveness can be invaluable during claims processing. Customer reviews often reflect satisfaction levels regarding claims handling and overall support.

Lastly, consider the flexibility of policies. Some companies allow customization of terms based on specific business needs, while others may have rigid offerings. Understanding these elements can lead to a more informed choice that aligns with the unique requirements of a business.

Client Reviews and Ratings for Liability Coverage Options

When selecting additional protection, client feedback plays a significant role. Reviews provide insights into the reliability and quality of various providers. Evaluating user experiences can guide S corporations in making informed decisions about their supplemental liability coverage.

Consider platforms such as Trustpilot and Consumer Affairs, where users share their experiences and rate service providers. Look for companies with consistently high ratings, as well as detailed reviews that highlight specific strengths and weaknesses.

Key Factors to Consider

- Claims Process: Clients often comment on how smoothly claims are handled. Positive reviews frequently mention quick responses and satisfactory resolutions.

- Customer Service: Ratings often reflect the quality of customer support. Look for providers praised for their responsiveness and helpfulness.

- Coverage Options: Feedback can reveal how well a provider meets diverse needs. Clients may discuss flexibility in policy terms and available add-ons.

- Pricing: Value for money is a common theme. Reviews will often compare prices with the level of service and coverage provided.

To assess the reputation of a provider, consider compiling ratings from multiple sources. A summary table can help visualize the overall performance of different companies:

| Provider | Trustpilot Rating | Consumer Affairs Rating |

|---|---|---|

| Provider A | 4.5/5 | 4.2/5 |

| Provider B | 4.0/5 | 3.8/5 |

| Provider C | 4.8/5 | 4.5/5 |

Incorporating client ratings and reviews into your decision-making process ensures a more tailored approach to securing additional coverage. Focus on providers with strong client feedback to enhance protection and peace of mind.

Best places to search for umbrella insurance for s corporations

Features

| Is Adult Product | |

| Release Date | 2022-06-27T00:00:01Z |

| Language | English |

| Number Of Pages | 305 |

| Publication Date | 2022-06-27T00:00:01Z |

Features

| Is Adult Product | |

| Edition | 3 |

| Language | English |

| Number Of Pages | 800 |

| Publication Date | 2015-02-24T00:00:01Z |

Video:

FAQ:

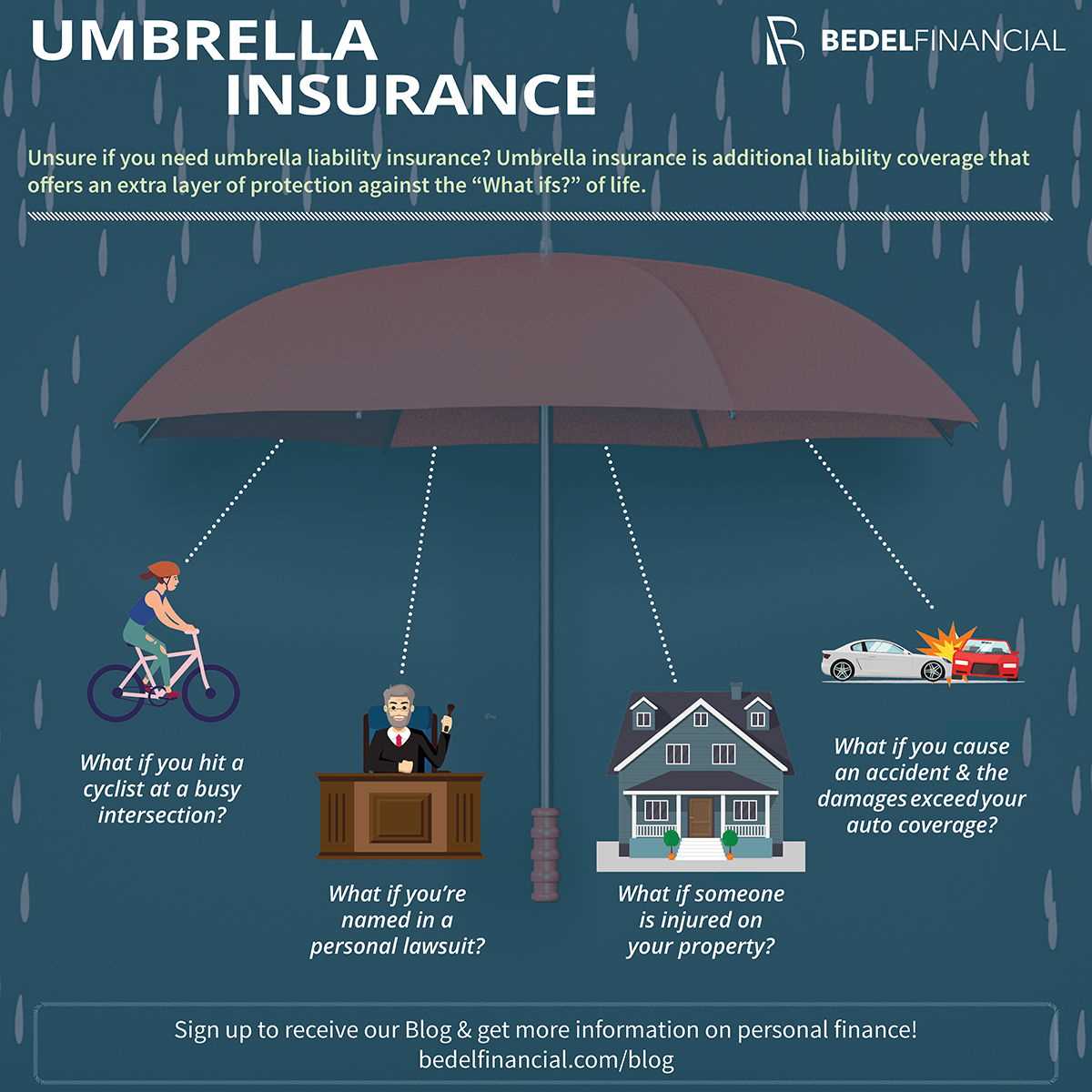

What is umbrella insurance and why is it important for S Corporations?

Umbrella insurance provides additional liability coverage beyond the limits of existing policies, such as general liability or auto insurance. For S Corporations, it is important because it protects the business against large claims or lawsuits that could exceed the limits of primary insurance policies. This extra layer of protection can safeguard company assets and ensure financial stability in the event of significant legal issues or claims.

Where can I find reliable umbrella insurance providers for my S Corporation?

Reliable umbrella insurance providers can be found through various channels. Consider starting with reputable insurance companies known for business insurance, such as State Farm, Allstate, or Progressive. Additionally, online insurance marketplaces allow you to compare policies from multiple providers. Consulting with an insurance broker who specializes in business coverage can also help you identify suitable options tailored to your S Corporation’s needs.

What factors should I consider when choosing umbrella insurance for my S Corporation?

When selecting umbrella insurance for your S Corporation, consider the following factors: the amount of coverage needed based on your business activities and exposure, the financial health and reputation of the insurance provider, any specific exclusions in the policy, and the cost of premiums. It’s also beneficial to evaluate how the umbrella policy integrates with your existing liability coverage to ensure comprehensive protection.

How much umbrella insurance coverage should an S Corporation typically carry?

The amount of umbrella insurance coverage an S Corporation should carry varies based on its size, industry, and risk exposure. A common recommendation is to have at least $1 million in umbrella coverage, but businesses with higher risks, such as those in construction or manufacturing, may need $2 million or more. Assessing potential liabilities and consulting with an insurance expert can help determine the appropriate coverage amount for your specific situation.