Consider assessing your current liability coverage to determine if you need additional protection. This article discusses the nuances of securing supplementary liability coverage, which can be invaluable for homeowners, renters, and vehicle owners seeking to protect their assets from unforeseen incidents.

You will find insights on evaluating your specific needs, understanding policy limits, and identifying potential risks that may require extra coverage. The content is tailored for individuals who want to enhance their financial security against lawsuits and claims that exceed standard policy limits.

By the end of this article, you will have a clear understanding of the steps to take when pursuing this type of protection, including how to compare different providers, the importance of annual reviews, and tips for adjusting coverage based on lifestyle changes. This knowledge will empower you to make informed decisions about your financial safety net.

Best Strategy to Purchase Additional Liability Coverage

Research is the foundation of acquiring additional liability coverage. Start by assessing your current policies to identify gaps in coverage that this type of policy can fill. Understanding your assets and potential risks will guide you in determining the appropriate amount of coverage needed.

Consult with a licensed insurance agent who specializes in liability products. They can provide insights into the nuances of different offerings and help tailor a plan that fits your specific needs. Be prepared to discuss your financial situation, lifestyle, and any existing coverage to receive the most accurate advice.

Evaluating Options

Gather quotes from multiple providers to compare rates and coverage options. It’s crucial to review not only the premiums but also the exclusions and limitations of each policy. A comprehensive comparison will highlight the most suitable choices for your circumstances.

- Check the financial stability of each insurance company through ratings from independent agencies.

- Inquire about any discounts available for bundling with existing policies.

- Read customer reviews to gauge service quality and claims handling.

Once you narrow down your options, request detailed policy documents. Pay close attention to the terms and conditions, ensuring you fully understand the coverage limits and any additional endorsements that may be beneficial.

| Provider | Coverage Limit | Annual Premium |

|---|---|---|

| Provider A | $1 million | $150 |

| Provider B | $2 million | $200 |

| Provider C | $1 million | $180 |

Finally, ensure you keep your policy updated as your circumstances change. Regular reviews will help you maintain adequate coverage and adjust limits as necessary.

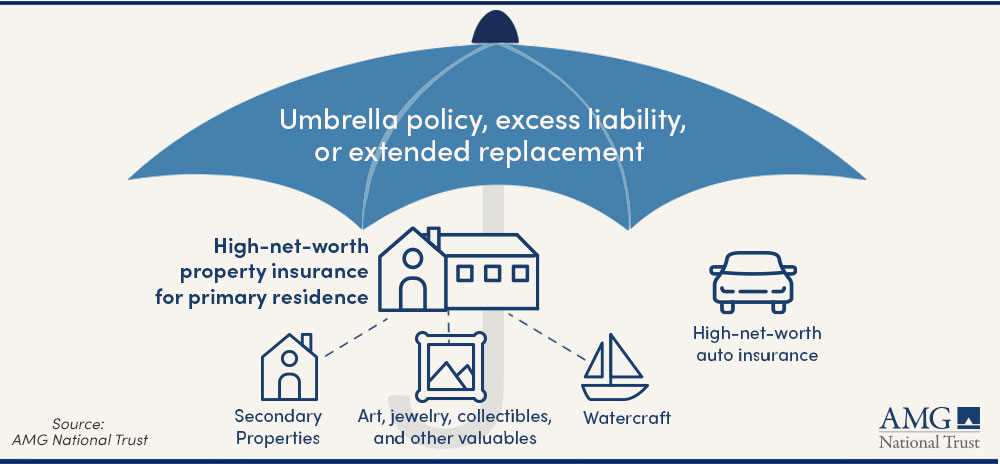

Understanding the Basics of Umbrella Coverage

Familiarizing yourself with additional liability protection is essential for safeguarding your financial assets. This type of coverage provides an extra layer of security beyond standard policies, like home or auto, ensuring that you are protected in various situations.

Coverage limits typically start at a significant amount, such as one million dollars, and can go much higher. This can be particularly beneficial in cases of major accidents or lawsuits where costs could exceed regular policy limits.

Key Features to Consider

Several aspects of this coverage are important to understand:

- Exclusions: Most policies have specific exclusions, such as claims related to business activities or intentional acts.

- Worldwide Coverage: Many plans extend protection outside the United States, which can be advantageous for travelers.

- Affordability: Generally, the cost of this type of coverage is relatively low compared to the amount of protection it offers.

It’s wise to evaluate your personal circumstances, such as assets and potential risks, to determine the appropriate amount of coverage needed. Consulting with an expert can provide tailored advice based on individual needs.

Evaluating Your Coverage Needs

Assessing individual coverage requirements is integral to ensuring adequate protection against unforeseen events. Begin by analyzing your existing assets, such as properties, vehicles, and savings. This analysis will provide a baseline for determining how much additional protection is necessary to safeguard your financial future.

Consider potential liabilities that could arise from accidents or incidents for which you may be held responsible. Understanding your lifestyle, including business activities or public engagements, can significantly impact the level of protection you require. Take specific steps to evaluate these factors.

Key Factors to Consider

- Personal Assets: Calculate the total value of your belongings, including real estate, investments, and personal items.

- Income and Future Earnings: Consider your current income and any potential future earnings that could be affected by legal actions.

- Family Considerations: Evaluate how liability claims could impact your loved ones and their financial stability.

- Risk Exposure: Identify activities that increase your risk of being sued, such as owning rental properties or participating in community events.

After assessing these factors, consult with an expert to discuss your findings. Tailoring a plan that meets your specific needs can offer peace of mind and ensure you are adequately covered against potential risks.

Comparing Quotes from Different Providers

Gathering quotes from various providers allows for an informed decision regarding additional liability coverage. Start by identifying multiple companies that offer this type of protection and compile their offerings in a structured manner.

Consider the following steps to streamline the comparison process:

- Research Providers: Look for reputable companies that have a history of customer satisfaction and reliability.

- Request Quotes: Reach out to each provider for a detailed quote. Ensure that the coverage limits and terms are comparable across providers.

- Analyze Coverage Options: Different companies may offer varying levels of protection. Pay attention to the specifics of what is included in the policy.

- Evaluate Premiums: Compare the costs associated with each quote, taking note of any additional fees or discounts that may apply.

- Examine Exclusions: Carefully read through the exclusions in each policy to understand what is not covered.

Creating a comparison table can be beneficial for visual clarity:

| Provider | Coverage Limit | Annual Premium | Key Exclusions |

|---|---|---|---|

| Provider A | $1 million | $150 | Intentional acts, personal injury |

| Provider B | $2 million | $200 | Business activities, professional services |

| Provider C | $1 million | $180 | Flood damage, certain dog breeds |

After gathering and analyzing quotes, weigh the benefits of each option against the costs. This detailed evaluation will facilitate a well-informed choice that aligns with your personal needs and financial situation.

Assessing Policy Limits and Exclusions

Reviewing policy limits and exclusions is essential for ensuring adequate coverage against potential liabilities. Understand the maximum payout amounts and the specific scenarios that the coverage does not address. This knowledge is crucial for making informed decisions regarding your financial protection.

Policy limits dictate the maximum compensation an insurer will provide for claims. If your assets or potential liabilities exceed these limits, you may face significant out-of-pocket expenses. Assess your total worth and consider how much coverage is necessary to protect your financial future.

Understanding Exclusions

Exclusions define the circumstances under which the policy will not provide coverage. Common exclusions may include:

- Intentional acts or criminal behavior

- Certain types of business liabilities

- Claims arising from specific natural disasters

Thoroughly read the policy documents to identify these exclusions. Engaging with an insurance professional can clarify the implications of these terms and help tailor coverage to fit your unique situation.

In addition to limits and exclusions, consider the potential for additional endorsements or riders that can enhance your policy. These modifications may offer extra coverage for specific scenarios that are otherwise excluded. Always weigh the cost of such additions against the potential benefits they provide.

Finalizing Your Purchase and Managing Your Policy

Carefully review the terms and conditions of your selected coverage before finalizing your purchase. Ensure that you understand all exclusions, limits, and the claims process. This diligence can save you from unexpected gaps in protection.

Once you have confirmed the details, complete the transaction with your chosen provider. Keep a copy of your policy documents in a secure location, both physical and digital. It is advisable to set reminders for renewal dates and review your coverage annually or after significant life changes.

Key Steps for Ongoing Management

- Regular Reviews: Schedule yearly assessments to ensure your coverage reflects your current lifestyle, assets, and potential risks.

- Updating Information: Notify your provider of any major changes such as purchasing a new property or starting a business.

- Claims Process: Familiarize yourself with the claims process, including necessary documentation and timelines.

- Consultation: Maintain an open line of communication with your insurance agent for guidance on coverage needs and adjustments.

Staying proactive about your policy can lead to better security and peace of mind. Regular evaluations and updates ensure that you are adequately protected against unforeseen events.

Best way to buy umbrella insurance

Features

| Is Adult Product | |

| Language | English |

| Number Of Pages | 206 |

| Publication Date | 2024-03-23T00:00:01Z |

Video:

FAQ:

What is umbrella insurance and why should I consider buying it?

Umbrella insurance is a type of liability coverage that provides additional protection beyond the limits of your standard insurance policies, such as auto or homeowners insurance. It is designed to help protect your assets in case you are held liable for an incident that exceeds your primary policy limits. For instance, if you are involved in a serious car accident and face a lawsuit that exceeds your auto insurance coverage, umbrella insurance can cover the additional costs. Many people consider this insurance to safeguard their savings and future earnings from potential lawsuits.

How do I determine how much umbrella insurance I need?

To figure out the appropriate amount of umbrella insurance, consider your total assets, including savings, property, and investments. A common guideline is to have enough coverage to protect at least your net worth. For example, if your assets total $500,000, you might want to consider an umbrella policy of at least that amount or more to ensure adequate protection. Additionally, think about your lifestyle and potential risks, such as owning a swimming pool or having teenage drivers, which could increase your liability exposure.

Where can I buy umbrella insurance?

You can purchase umbrella insurance through various channels, including insurance agents, brokers, and directly from insurance companies. It’s advisable to start by checking with your current insurance provider, as they may offer a multi-policy discount if you bundle your umbrella policy with existing coverage like home or auto insurance. Alternatively, you can shop around online and compare quotes from different insurers to find the best rates and coverage options that fit your needs.

Are there any exclusions I should be aware of with umbrella insurance?

Yes, umbrella insurance typically has exclusions that you should understand before purchasing a policy. Common exclusions include liability arising from intentional harm, business-related activities, and certain types of claims like those involving professional services. Additionally, some policies may not cover incidents that occur in certain locations or during specific activities, such as using a vehicle for ride-sharing. It’s important to read the policy details carefully and discuss any concerns with your insurance agent to ensure you have the coverage you need.

How much does umbrella insurance cost, and is it worth the investment?

The cost of umbrella insurance can vary widely based on factors such as your location, the amount of coverage you choose, and your personal risk profile. On average, premiums can range from $150 to $300 per year for a $1 million policy. Many people find this cost reasonable considering the significant financial protection it offers against lawsuits and claims that could otherwise threaten their savings and assets. Evaluating your individual circumstances and potential liability risks can help you decide if this coverage is a worthwhile investment for your peace of mind.