Choosing the right supplemental liability coverage can significantly enhance your financial protection against unforeseen events. This article provides an analysis of leading providers in the market, helping you make an informed choice based on your unique needs. You will find detailed reviews of each service, including their coverage limits, pricing structures, and customer satisfaction ratings.

This content is tailored for individuals and families seeking additional protection beyond standard policies. If you own valuable assets or have significant liabilities, understanding these options is crucial. By the end of this article, you will have a clearer understanding of which providers align with your requirements and how to secure the best terms.

In summary, we will explore various service providers, highlighting their advantages and potential drawbacks. This guide aims to equip you with the knowledge to enhance your protection and ensure peace of mind in an unpredictable world.

Recommended Providers for Additional Liability Coverage in California

For those seeking supplementary liability protection in California, several providers stand out due to their comprehensive offerings and solid customer support. These options are tailored to meet various needs, ensuring adequate coverage against potential claims that exceed standard policies.

Research indicates that many individuals benefit from policies that offer extensive limits, often exceeding one million dollars. Such coverage is particularly valuable for homeowners or renters who may face substantial claims from accidents or incidents occurring on their property.

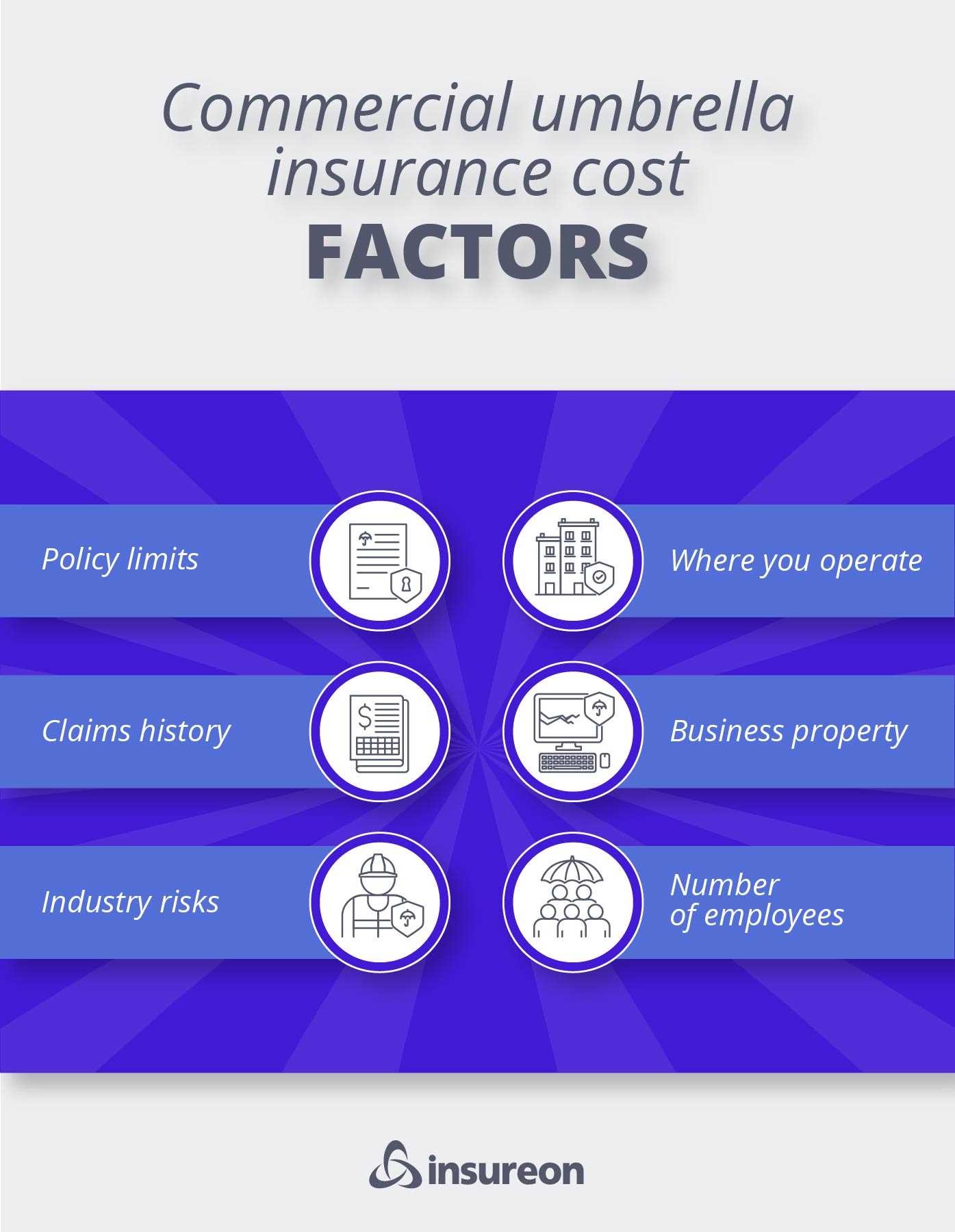

Key Factors to Consider

- Coverage Limits: Evaluate the maximum amount of liability coverage available, as this can significantly impact your financial security.

- Cost: Compare premiums across different providers to find a balance between affordability and adequate protection.

- Claims Process: Investigate the ease of filing claims and the responsiveness of the customer service teams.

- Reputation: Look into customer reviews and ratings to gauge overall satisfaction with the provider’s services.

Many consumers have found that a combination of competitive pricing and positive customer experiences leads to greater peace of mind. By obtaining quotes from multiple sources, individuals can make informed decisions that align with their specific circumstances.

Ultimately, securing reliable additional liability coverage enhances financial protection, ensuring that unexpected incidents do not lead to significant financial setbacks.

Top-Rated Providers for Umbrella Coverage in California

Finding reliable coverage for additional liability protection is essential for homeowners and renters in California. Several providers stand out in the market, offering comprehensive policies that cater to various needs and budgets.

A key factor in selecting coverage is the financial stability of the provider. Many highly regarded insurers have strong ratings from independent agencies, indicating their ability to pay claims. Additionally, customer service and claims handling are crucial aspects to consider, as they reflect the overall experience policyholders can expect.

Leading Options to Consider

- Provider A – Known for their competitive pricing and extensive coverage options, they offer flexibility in policy customization, making it suitable for individuals with unique needs.

- Provider B – Offers a strong reputation for customer service, with many positive reviews highlighting their responsiveness during the claims process.

- Provider C – This insurer is recognized for its robust financial ratings, ensuring peace of mind for policyholders regarding the security of their coverage.

- Provider D – They provide a range of discounts for bundling policies, which can lead to significant savings for customers looking to combine different types of protection.

When evaluating these options, consider their specific policy features, such as coverage limits, exclusions, and any additional benefits that may be included. Assessing customer feedback can also provide insights into the overall satisfaction of existing policyholders.

In conclusion, selecting an appropriate provider requires thorough research and consideration of personal circumstances. By focusing on these reputable options, you can ensure you have the necessary protection against unforeseen events.

Key Features to Look for in Umbrella Policies

When evaluating additional liability coverage, focus on limits and coverage breadth. Ensure the policy offers substantial limits beyond existing policies, providing a cushion against significant claims. This is crucial for safeguarding assets in the event of lawsuits or major incidents.

Examine the exclusions listed in the policy. Understanding what is not covered can prevent unexpected gaps in protection. Look for policies that minimize exclusions and provide coverage for a variety of scenarios, including personal injury claims, property damage, and certain legal defense costs.

Additional Aspects to Consider

- Coverage for Personal and Business Liabilities: Select a plan that encompasses both personal and business-related incidents if applicable.

- Defense Costs: Check if legal expenses are covered in addition to the liability limits, as these costs can quickly escalate.

- Global Coverage: Policies that extend coverage internationally can be beneficial for those traveling or living abroad.

- Claims Handling Process: Investigate the claims process and customer service reputation of the provider, as efficient handling can make a significant difference during stressful times.

Consider the premium costs versus coverage benefits. A lower premium may seem attractive but could result in inadequate protection. Balance affordability with comprehensive coverage to ensure peace of mind.

Lastly, review the insurer’s financial stability and customer reviews. A financially sound provider with positive feedback indicates reliability in fulfilling claims.

Comparative Analysis of Premium Rates Across Leading Insurers

Analyzing premium rates reveals significant variations among different providers in the market. The average annual costs can range widely based on factors such as coverage limits, individual risk profiles, and the financial strength of each provider. A detailed examination shows that some insurers offer lower initial premiums but may lack comprehensive coverage options, while others charge a higher rate with robust protection features.

When assessing premium rates, consider obtaining quotes from multiple sources. This not only aids in understanding the general pricing trends but also highlights the importance of customizing coverage according to personal needs. Some insurers might provide discounts based on existing policies, claims history, or risk mitigation measures, which can further affect the overall cost.

Rate Comparison Table

| Provider | Average Annual Premium | Coverage Limit |

|---|---|---|

| Insurer A | $150 | $1 million |

| Insurer B | $200 | $1 million |

| Insurer C | $175 | $2 million |

| Insurer D | $250 | $1 million |

It is essential to analyze not just the cost but also the breadth of coverage included in each policy. Some providers may offer broader liability limits or additional features such as legal defense, which can be invaluable in case of a claim. Review policy details carefully to ensure the chosen option meets specific requirements.

Finally, the financial stability of each provider can impact long-term value. Researching ratings from independent agencies can help gauge reliability, ensuring that the chosen entity can meet its obligations in the event of a claim. A balanced approach considering both cost and quality will yield the best outcomes.

Customer Satisfaction Ratings for Umbrella Coverage Providers

Customer satisfaction ratings serve as a valuable metric for evaluating coverage providers. High ratings often indicate reliability, quality of service, and overall client contentment. Many consumers prioritize these ratings when selecting a provider, understanding that positive experiences can lead to better support and fewer issues in the future.

Surveys and reports consistently highlight key aspects that influence customer satisfaction. Factors such as claims processing speed, customer service responsiveness, and policy clarity play significant roles in shaping opinions. Clients appreciate straightforward communication and efficient handling of inquiries, which contribute to a positive overall experience.

Key Elements Influencing Satisfaction

- Claims Handling: Quick and fair resolution of claims is a major determinant of satisfaction. Clients favor providers who process claims smoothly and transparently.

- Customer Support: Accessibility and helpfulness of customer service representatives greatly impact client feelings about their provider. Prompt responses to questions or concerns are crucial.

- Policy Transparency: Clear explanations of coverage terms and conditions ensure clients feel informed and secure in their decisions.

Ratings from independent organizations and customer feedback platforms often reflect these key elements. Prospective clients are encouraged to consult these ratings and reviews to gauge the reliability and service quality of various coverage providers in their area.

Additional Coverage Options Offered by Major Insurers

Many insurers provide a variety of supplementary protection choices that enhance standard policies. These options can be tailored to meet individual needs, offering peace of mind in unexpected situations. Understanding these additional coverages is essential for making informed decisions.

Among the common offerings are personal liability protection, which safeguards against claims from bodily injury or property damage caused by you or a family member. Coverage for personal injury, including false arrest and defamation, is also available, addressing legal costs in such scenarios.

Other Noteworthy Options

- Additional Living Expenses: This can assist with costs incurred if you need to vacate your home due to a covered event.

- Legal Defense Costs: Coverage for attorney fees and related expenses in case of lawsuits can be beneficial.

- Worldwide Coverage: Some insurers extend their protection beyond local boundaries, covering incidents that occur while traveling.

- Specialized Coverage: This includes options for specific assets, such as art collections or jewelry, which may exceed standard policy limits.

Each provider has unique variations of these offerings, making it important to review the details closely. Customizing coverage can lead to a more robust safety net, ensuring that clients are well-protected against various risks.

How to Choose the Right Umbrella Provider for Your Needs

Evaluate the coverage options carefully to ensure they align with your personal and financial situation. Look for providers that offer customizable plans, allowing you to enhance your protection based on specific risks you face.

Assess the financial stability and customer service reputation of potential providers. A company with strong financial backing and positive reviews will give you confidence that they can handle claims effectively.

Key Factors to Consider

- Coverage Limits: Determine the amount of additional liability coverage you need based on your assets and potential risks.

- Cost: Compare premiums from different providers to find a balance between affordability and comprehensive coverage.

- Exclusions: Review what is not covered under the policy, as these details can significantly impact your protection.

- Claims Process: Research how easy it is to file a claim and the average time it takes for resolution.

- Discounts: Inquire about available discounts for bundling policies or having a good claims history.

By focusing on these elements, you can make an informed decision that provides the necessary protection for your assets and peace of mind.

Best umbrella insurance companies in california

Video:

FAQ:

What are the key benefits of having umbrella insurance in California?

Umbrella insurance provides an additional layer of liability protection beyond what standard policies cover, such as auto or homeowners insurance. This means that if you face a lawsuit or a claim that exceeds the limits of your primary insurance, your umbrella policy can cover the extra costs. This type of insurance is especially valuable in California due to the potential for high legal costs and large settlements. Additionally, umbrella insurance often covers incidents that may not be included in your primary policies, such as slander, libel, or certain lawsuits related to personal injury. Overall, it offers peace of mind and financial security against unexpected events.

How do I choose the best umbrella insurance company in California?

Choosing the right umbrella insurance company involves several steps. First, research the reputation of various insurers by checking customer reviews and ratings from organizations like J.D. Power or AM Best. Look for companies that have a strong financial stability rating, as this indicates they can handle claims effectively. Compare policy offerings, including coverage limits and any exclusions. It’s also important to evaluate the cost of premiums and whether discounts are available for bundling policies. Finally, consider the customer service experience by reaching out with questions or concerns to see how responsive they are. Consulting with an insurance agent can also provide personalized insights tailored to your specific needs and circumstances.