To maximize your financial protection, consider purchasing a policy that extends beyond the limits of your primary coverage. This additional layer can safeguard your assets against significant liabilities that may arise from unforeseen incidents.

This article outlines key techniques for selecting the right supplementary coverage, focusing on specific scenarios where it can provide crucial support. Whether you are a homeowner, a renter, or someone with substantial assets, this information will help you understand the benefits and considerations involved in enhancing your current protection.

We will explore the types of risks that often exceed standard limits, how to assess your individual needs, and the importance of a thorough review of your existing policies. By the end, you will be equipped with actionable insights to ensure your financial stability in case of major claims.

Optimal Coverage Approach

Identify your assets and potential risks. This foundational step allows for tailored additional liability coverage that reflects your personal circumstances. Consider evaluating property, savings, and future income to ascertain the appropriate amount of protection needed.

Engage with an insurance professional who understands your specific requirements. They can provide insights into the necessary limits and potential gaps in your current policies. A comprehensive evaluation can help avoid underinsurance or excessive premiums.

Assessing Coverage Needs

Regularly reassess your situation, especially after significant life changes such as home purchases, career advancements, or family expansions. These events can alter your risk profile and necessitate adjustments in your coverage levels.

- Review existing liability limits on home and auto policies.

- Consider potential legal fees and settlements in your area.

- Factor in any personal or business activities that may increase risk exposure.

Additionally, maintain a clear understanding of exclusions in your policies. Specific activities or situations may not be covered, which can impact your overall protection strategy. Proactively addressing these aspects can lead to better preparedness and peace of mind.

Finally, bundling various policies can lead to cost savings while ensuring cohesive coverage. This approach simplifies management and may enhance your overall security by creating a robust network of protection.

Understanding Coverage Limits and Their Importance

Choosing the right coverage limits is fundamental to safeguarding personal assets. A well-considered approach ensures that financial protection aligns with individual risk exposure. It is critical to assess the potential costs associated with various liabilities, as inadequate limits can leave significant financial gaps.

Coverage limits represent the maximum amount an insurer will pay for claims. Understanding these limits is vital, as they dictate the extent of financial protection in case of an incident. For instance, if a policyholder is found liable for damages exceeding their limit, they may be responsible for the remaining balance, which can lead to severe financial strain.

The Role of Coverage Limits in Risk Management

Evaluating personal and professional assets helps determine appropriate coverage limits. This process involves identifying potential risks that could lead to liability claims. Factors such as property ownership, business operations, and lifestyle choices should be analyzed thoroughly.

- Homeowners: Assess the value of the home and its contents to establish adequate limits.

- Vehicle Owners: Consider the risk of accidents and property damage to determine necessary coverage.

- Business Owners: Evaluate business practices and potential liabilities to set appropriate limits.

Additionally, individuals should consider the legal environment in their region. Some areas have higher liability risk due to factors like population density and local laws. In such cases, opting for higher coverage limits can provide an added layer of security.

| Type of Coverage | Recommended Minimum Limit |

|---|---|

| Personal Liability | $1 million |

| Property Damage | $300,000 |

| Legal Defense Costs | Varies |

Ultimately, reviewing and adjusting coverage limits should be a regular practice. As personal circumstances evolve, so should the level of protection in place. Regular consultations with insurance professionals can provide valuable insights into optimizing coverage and ensuring long-term financial stability.

Evaluating Your Personal Risk Factors

Assessing personal risk factors is a fundamental step in determining the appropriate level of coverage against unforeseen events. Understanding these factors allows for an informed decision on how much extra protection is necessary to safeguard assets and finances.

Begin by analyzing your lifestyle and daily activities. High-risk professions, frequent travel, or engaging in activities such as sports can significantly elevate exposure to liability claims. Identifying these areas is crucial for establishing the right amount of supplementary coverage.

Key Risk Areas to Consider

- Home Environment: Consider the safety of your home and the surrounding area. Properties with pools, trampolines, or located in areas prone to natural disasters may require additional safeguards.

- Family Dynamics: The number of dependents or household members can influence risk. Young children or pets can lead to increased liability concerns.

- Assets: Evaluate the total value of your assets, including homes, vehicles, and savings. The more you have, the more protection you may need against potential lawsuits.

- Community Involvement: Participation in community events or organizations can increase exposure to potential claims, necessitating further evaluation of coverage needs.

After identifying these risk factors, it’s beneficial to consult with a knowledgeable advisor who can help tailor a protective plan suited to your specific situation. This personalized approach ensures that you are not underinsured and that your assets are adequately protected against unforeseen liabilities.

Choosing the Right Policy for Your Needs

Selecting an appropriate coverage plan requires careful assessment of individual circumstances. Begin by evaluating your assets, including property, savings, and potential future earnings. This assessment will help determine the level of protection necessary against unforeseen liabilities.

Next, consider the specific risks associated with your lifestyle and activities. If you frequently host gatherings, participate in sports, or own rental properties, your exposure to potential claims increases. Tailoring your coverage to reflect these factors ensures adequate protection.

Evaluating Policy Features

When examining different plans, focus on key features that align with your requirements. Look for policies that provide:

- Coverage Limits: Ensure limits are sufficient to cover your total assets and potential legal costs.

- Exclusions: Understand what is not covered to avoid surprises during claims.

- Claim Process: Investigate how claims are handled and the responsiveness of the provider.

Comparing multiple options side by side can clarify which policy meets your needs most effectively. Consulting with a knowledgeable advisor can provide insights tailored to your unique situation.

Cost Considerations

Price is a significant factor, but it should not be the only consideration. Analyze the cost relative to the coverage offered. Sometimes, a lower premium may lead to inadequate protection. Evaluate discounts for bundling with other types of coverage, which can enhance value.

In conclusion, making an informed choice involves a thorough analysis of personal assets, risks, policy features, and costs. Taking the time to understand these aspects will lead to a more secure financial future.

Integrating Additional Coverage with Existing Policies

To maximize the benefits of supplementary coverage, it is vital to align it with current policies. This ensures a comprehensive safety net against potential liabilities. Evaluate the coverage limits of your primary policies to determine the appropriate amount of extra protection needed.

Reviewing your existing policies should involve a detailed analysis of coverage types such as home, auto, and personal liability. Ensure that the additional coverage fills any gaps and complements your current protection structures.

- Assess existing liability limits on home and auto policies.

- Identify any high-risk activities or assets that require enhanced protection.

- Consult with an insurance advisor to tailor the additional coverage to your specific needs.

- Ensure that all policies work in tandem to prevent coverage overlaps or gaps.

Regularly revisiting and updating your coverage is necessary to adapt to changes in assets, lifestyle, or legal requirements. This proactive approach will help maintain optimal protection against unforeseen events.

In conclusion, integrating additional coverage with your existing policies requires careful evaluation and planning. By ensuring that all elements work together harmoniously, you can create a robust safety net that effectively mitigates risks.

Best umbrella insurance strategy

Features

| Is Adult Product | |

| Edition | 3 |

| Language | English |

| Number Of Pages | 800 |

| Publication Date | 2015-02-24T00:00:01Z |

Features

| Release Date | 2021-10-08T00:00:00.000Z |

| Edition | 5 |

| Language | English |

| Number Of Pages | 2025 |

| Publication Date | 2021-10-08T00:00:00.000Z |

| Format | Kindle eBook |

Video:

FAQ:

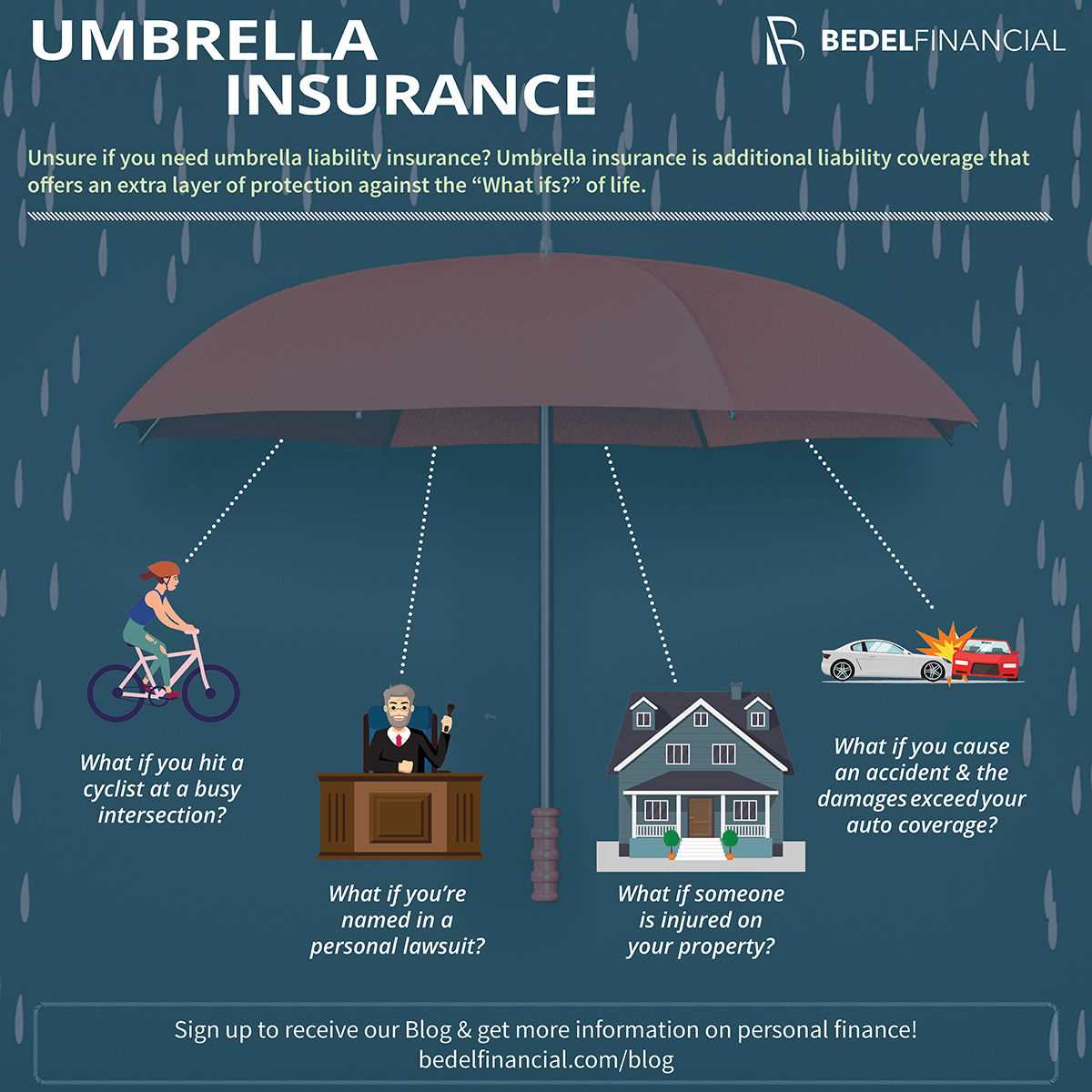

What is umbrella insurance and why do I need it?

Umbrella insurance is a type of liability insurance that provides additional coverage beyond the limits of your standard policies, such as auto or homeowners insurance. It protects you from major claims and lawsuits, offering peace of mind in case of unexpected incidents. If, for example, you are involved in a serious car accident that results in significant damages, your auto insurance may not cover all costs. Umbrella insurance can help cover the excess amount, ensuring that your personal assets are protected from being depleted by legal fees or settlements. This type of policy is particularly beneficial for individuals with substantial assets or those who are at a higher risk of facing lawsuits.

How much umbrella insurance coverage should I consider purchasing?

The amount of umbrella insurance you should consider typically depends on your personal financial situation, assets, and risk exposure. A common recommendation is to start with at least $1 million in coverage, as this often provides adequate protection for most individuals. However, if you own valuable property, have significant savings, or are in a profession that increases your risk of being sued, you might want to opt for higher limits, such as $2 million or more. Evaluating your current assets and potential liabilities can help you determine the appropriate level of coverage to safeguard your financial future.

Are there any exclusions I should be aware of with umbrella insurance policies?

Yes, while umbrella insurance offers extensive coverage, there are specific exclusions you should be mindful of. Common exclusions include intentional acts, business-related liabilities, and certain types of claims such as those arising from personal injury or property damage caused by your rental properties or vehicles. Additionally, some policies may not cover specific incidents like slander or defamation unless explicitly included. It is essential to read the policy details carefully and discuss any concerns with your insurance agent to ensure you fully understand the limitations and coverage of your umbrella insurance.