Consider adding a clause to your policy that addresses the loss of personal items. Many standard contracts include provisions that address loss, theft, or damage during transit, but specific terms can vary significantly by provider.

Verify the limits of reimbursement for lost items. Some plans may offer only partial compensation based on depreciated values or set monetary caps. It’s advisable to maintain a detailed inventory of valuable items, along with receipts, to substantiate your claim.

Review any associated deductibles that could affect the overall reimbursement amount. Understanding these details beforehand can save you from unexpected expenses when filing a claim. Additionally, inquire whether coverage extends to casual items, as not all providers treat these the same.

Always check for specific exclusions that may apply. Certain policies might not extend coverage to particular situations like unattended belongings or items checked in with airlines. Reading the fine print will clarify what protections are offered for different circumstances.

Travel Coverage for Lost Gear

Read the policy documents carefully for clarity on compensation for lost possessions. Many providers do include provisions for missing property, but specifics vary significantly. Check for limits on the reimbursement amounts and any requirements such as proof of ownership or valuations.

Factors Influencing Compensation

Payment often depends on when the theft occurred–during transit, at a hotel, or elsewhere. Conditions around reporting the incident, such as immediate notification to authorities, can impact claims. Some plans might only reimburse after deductibles have been met, so understanding your plan’s terms is essential.

Prevention and Preparation

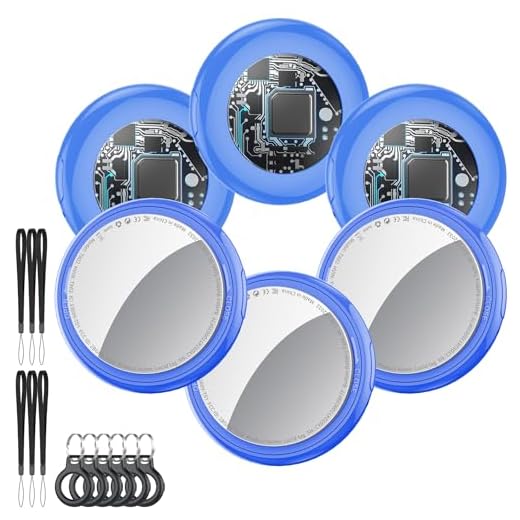

Consider taking preventive measures such as tracking devices for your belongings and keeping valuables in carry-on bags. Documenting items with photographs and keeping receipts can also aid in swift claim processing in case of loss. Always consult with your provider to ensure your specific items are adequately protected under your policy.

Understanding What Travel Protection Typically Includes

Policies generally incorporate a range of safeguards, which may encompass:

- Medical Expenses: Coverage for emergency healthcare and medical evacuations due to accidents or illnesses during your trip.

- Trip Cancellation: Reimbursement for pre-paid, non-refundable expenses if unforeseen events force you to cancel.

- Trip Interruption: Compensation for lost costs when a journey is interrupted due to emergencies, illness, or other valid reasons.

- Personal Liability: Financial protection against claims made by others for accidental injuries or damages caused by you.

- Loss or Damage of Personal Belongings: Financial reimbursement for personal items lost or damaged, not necessarily restricted to baggage.

It’s essential to scrutinize your chosen policy’s terms, as each plan varies in scope and specifics. Pay particular attention to:

- Coverage limits: Check the maximum amount you can claim for each type of incident.

- Exclusions: Identify situations that are not included, such as pre-existing conditions or certain high-risk activities.

- Claim Process: Understand what documentation is necessary and the timeframe for filing claims after an incident occurs.

Before purchasing a plan, assess your requirements based on trip details and personal needs to ensure adequate coverage.

Identifying Types of Travel Insurance for Luggage

Consider a policy that specifically addresses lost or misplaced property. These plans usually reimburse for personal belongings that go missing, often including limits based on the item’s category and value.

Another type includes packages that feature comprehensive coverage, which may protect against theft and damage during transit. It’s crucial to check the conditions regarding claims to ensure your possessions are adequately safeguarded.

Look into policies that emphasize delayed baggage coverage. This often kicks in after a specific period, providing funds for essentials, which can also include clothing and toiletries to mitigate immediate needs.

Assess options that provide worldwide support, ensuring benefits are accessible regardless of your location. Review the terms to confirm the international scope of coverage aligns with your travel destination.

Examine policies with customizable add-ons, allowing you to specify the value of specific items. This ensures higher-end electronics or jewelry have appropriate limits, enhancing financial protection.

Lastly, check for exclusions related to high-risk activities. Engaging in adventure sports might void claims, so understanding these stipulations can prevent unexpected issues when filing for reimbursement.

Key Steps to Take After Your Luggage is Missing

Immediately report the incident to the local authorities and the airline or transport company. Obtain a copy of the police report and a reference number from the airline, as these are crucial for your potential claims.

Document Everything

Keep detailed records of your possessions. Create a comprehensive list of what was in your case, including descriptions and estimation of values. Photographs of the items can also support your situation.

Communicate with Your Airline or Transport Provider

Follow up regularly with the company responsible for your belongings. Initiate inquiries regarding their tracking process and any updates on recovery efforts. Maintain a log of all communications for later reference.

| Step | Action |

|---|---|

| Report Incident | Notify local authorities and transport provider. |

| Document Items | List and photograph contents of the missing case. |

| Request Updates | Stay in contact with the airline for recovery status. |

| Review Compensation Policy | Check guidelines for reimbursement claims. |

Review the guidelines for reimbursement from the relevant agencies, ensuring compliance with their requirements. Use your collected evidences to submit a claim and seek timely compensation.

Documentation Required to File a Claim for Lost Belongings

Gather specific documents to streamline the process of claiming for missing items. Start with a police report, as this serves as an official record of the incident. Ensure it includes details such as the date, location, and description of the lost possessions.

Next, collect your original purchase receipts for the items lost, including any travel essentials like the best messenger bag for artists or the best cimpact beach umbrella. These receipts establish the value of your belongings and support your claim for reimbursement.

Photographs of the items, especially high-value products like the best digital camera for 9 year old boy, can further substantiate your claim. Make sure to provide clear images showing the item along with any serial numbers if applicable.

Document your travel itinerary, including booking confirmations and boarding passes, to verify your travel details at the time of the incident. It’s also beneficial to have any correspondence with airlines or other transport authorities regarding the loss.

Lastly, keep a record of any additional costs incurred due to the incident, such as temporary replacements or essentials purchased after the loss, as these may also be compensable.

Common Exclusions in Travel Insurance Policies

Exclusions can significantly impact your financial protection. Familiarize yourself with these common restrictions that may limit your coverage:

Pre-existing Conditions: Policies often exclude items lost or damaged due to pre-existing conditions, including health issues that were known before the trip.

Negligence: Losses resulting from lack of reasonable care, such as leaving belongings unattended, typically will not be compensated.

Valuables and High-Value Items: Many policies have limits on reimbursement for high-value items like electronics, jewelry, or designer goods unless additional coverage is purchased.

Acts of War or Terrorism: Losses during times of conflict or political unrest may fall outside standard coverage agreements.

Unapproved Providers: Claims for replacement or reimbursement might be denied if items aren’t documented or provided by an unapproved service.

Unforeseen Circumstances: Losses resulting from natural disasters or events occurring during specific times, like strikes or pandemics, might be excluded unless specifically covered.

Travel Arrangements: Policies generally do not include reimbursement for additional expenses incurred due to changes in your itinerary unrelated to your possessions.

Review your policy thoroughly to understand these exclusions, and consider discussing your coverage needs with your provider to ensure proper protection during your travels.

How to Choose the Right Coverage for Your Needs

Select a plan that aligns with your personal preferences and travel habits. Review available options based on trip duration, destinations, and activities planned. If your itinerary includes adventurous pursuits, opt for policies that include specific benefits for those activities.

Assess the maximum payout limits on personal belongings, ensuring they meet your requirements. Inquire about the options for additional coverage in case you possess high-value items. Some policies allow for customization to suit particular needs.

Consider the policy’s claim process. Look for clear guidelines regarding how to file a claim and the expected turnaround time for reimbursements. A streamlined process with responsive customer service can alleviate stress in unfortunate situations.

Research the insurer’s reputation through customer reviews and ratings. Prioritize companies with a solid track record of handling claims effectively and providing excellent support. Seek recommendations from friends or family who have had positive experiences.

Pay attention to exclusions that may limit your coverage. Read the fine print to identify what circumstances or items might not be compensated. This information is key in avoiding unpleasant surprises.

Evaluate the cost of premiums in relation to potential benefits. Sometimes, policies with lower prices may not encompass essential protections. Strive for a balance between affordability and comprehensive coverage.

Finally, check if the provider offers emergency assistance services. Having access to support while abroad can make a significant difference in resolving issues quickly and efficiently.