If you want to enhance your financial protection beyond standard insurance, you’ve found the right resource. This article provides a detailed analysis of comprehensive coverage options that extend and complement your existing policies. By exploring various types of supplemental insurance, you’ll gain insights into how to safeguard your assets against unexpected events.

This content is particularly beneficial for homeowners, renters, and individuals with significant assets who seek to mitigate their liability risks. It will guide you through the key features of different offerings, helping you determine the best fit for your situation.

The article covers essential aspects such as coverage limits, pricing structures, and specific scenarios where this additional protection can be advantageous. You will also find practical tips on comparing quotes and selecting a provider that aligns with your needs. With the right information at your fingertips, you can make informed decisions that bolster your financial security.

Best Rate Umbrella Coverage

For individuals seeking comprehensive financial protection, exploring a well-structured excess liability coverage can provide peace of mind. This type of plan extends beyond standard policies, offering additional security against unforeseen events that may result in significant financial loss.

To determine the most suitable choice, consider the following factors: the extent of coverage required, the premium costs, and the specific exclusions associated with each option. It’s essential to assess personal assets and potential risks to gauge the necessary level of extra protection.

Key Features to Evaluate

- Coverage Limits: Look for high coverage limits that adequately protect against large claims.

- Exclusions: Thoroughly review policy exclusions to understand what is not covered.

- Premium Costs: Compare premium rates to find an option that balances cost with the level of protection offered.

- Claim Process: Research the efficiency of the claim process, as a streamlined procedure can be crucial during stressful times.

Many providers offer customizable plans, allowing individuals to tailor their coverage to meet specific needs. Consulting with an insurance expert can also provide valuable insights into the nuances of various offers, ensuring that the selected option aligns with personal financial goals.

Ultimately, thorough research and careful evaluation will lead to a more informed decision, securing the best possible excess liability protection for your circumstances.

Understanding the Basics of Umbrella Insurance

Umbrella coverage serves as an additional layer of liability protection beyond standard insurance plans. It helps safeguard personal assets from claims that may exceed the limits of primary policies such as auto or homeowners insurance.

This form of insurance is particularly beneficial for individuals with significant assets or those who are at higher risk of being sued. It provides peace of mind, ensuring that one remains financially secure in unexpected situations.

Key Features of Umbrella Coverage

Several important aspects characterize this type of insurance:

- Excess Liability: It kicks in when the limits of primary insurance are reached, covering additional expenses related to legal fees and damages.

- Broader Scope: This coverage often extends to claims not typically included in standard policies, such as slander or defamation.

- Affordable Premiums: Despite offering substantial coverage, the cost of this protection is generally low compared to the amount of liability it covers.

Choosing the appropriate level of coverage depends on individual circumstances. It is advisable to evaluate the total value of personal assets and potential risks when selecting a suitable amount of protection.

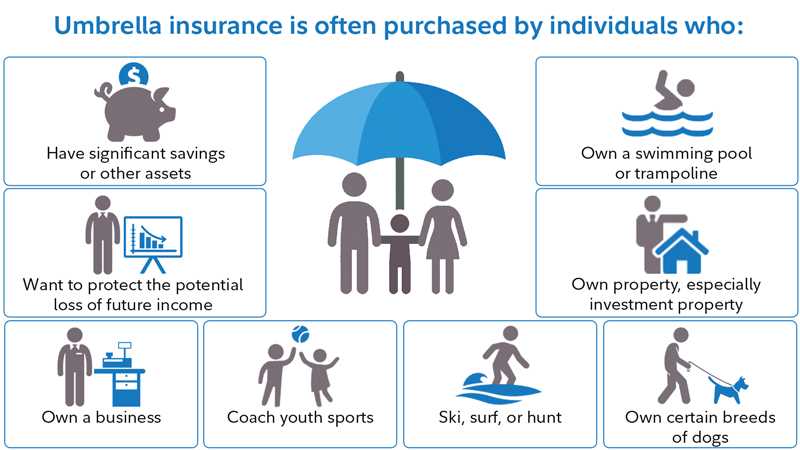

Who Should Consider This Type of Insurance?

Individuals in specific situations may find this coverage particularly advantageous:

- Property owners with high-value real estate.

- Individuals with a high net worth or substantial savings.

- People with a public presence or those frequently hosting gatherings.

In summary, additional liability coverage can offer significant protection for personal wealth. Assessing one’s risk and asset portfolio can aid in determining if this insurance is a prudent choice.

Key Factors Influencing Umbrella Coverage Prices

Several elements play a significant role in determining the costs associated with supplemental liability insurance. Understanding these factors can help individuals and businesses make informed decisions when seeking coverage.

The first major aspect is the level of coverage needed. Higher limits typically result in increased premiums. It’s essential to assess potential risks and select limits that adequately protect against possible claims.

Influential Factors

- Claims History: A history of previous claims can lead to higher premiums, as insurers view this as an indicator of future risk.

- Personal Assets: The more valuable the assets to protect, the higher the coverage limits required, influencing the overall cost.

- Location: Geographic factors, including local crime rates and natural disaster risks, can affect pricing. Areas prone to certain risks may see elevated costs.

- Driving Records: For those including auto coverage, a clean driving record can lead to lower premiums, while violations can elevate costs.

- Credit Score: Many insurers consider credit scores when determining premiums, as a lower score may indicate higher risk.

Taking into account these factors can guide individuals in selecting appropriate coverage while managing costs effectively. Regularly reviewing coverage limits and personal circumstances can also lead to better pricing over time.

Comparative Analysis of Leading Insurance Providers

For individuals seeking comprehensive coverage, evaluating various insurance companies is essential. Each provider offers distinct features, pricing structures, and customer service experiences that can significantly impact the decision-making process.

A thorough examination of major insurers reveals differences in policy limits, exclusions, and additional benefits. Some organizations prioritize extensive liability coverage, while others focus on offering bundled services at competitive prices.

Key Factors to Consider

- Coverage Options: Review the types of protection available, ensuring they align with personal needs and risk exposure.

- Claims Process: Investigate the efficiency and customer satisfaction regarding claims handling, which can be a critical aspect during emergencies.

- Customer Support: Assess the quality of customer service, including accessibility and responsiveness to inquiries or issues.

- Discounts and Bundling: Explore potential savings through multi-policy discounts or special offers for bundling various insurance products.

To facilitate a more informed choice, a comparison table can illustrate the differences among key players in the market:

| Provider | Coverage Options | Claims Satisfaction | Discounts Available |

|---|---|---|---|

| Provider A | Extensive | High | Yes |

| Provider B | Moderate | Medium | Yes |

| Provider C | Comprehensive | Very High | No |

Conducting a comparative analysis enables individuals to make well-informed decisions tailored to their specific circumstances. By focusing on coverage features, customer feedback, and potential savings, one can select the most appropriate provider for their needs.

How to Maximize Discounts on Your Umbrella Coverage

Bundling multiple insurance products can lead to significant savings. Many providers offer reduced rates when clients choose to combine their home, auto, and liability insurance under one roof. This strategy not only simplifies management but also enhances the likelihood of receiving a more advantageous financial package.

Regularly reviewing and updating your coverage limits can also contribute to lower premiums. As your financial situation evolves, you may find that certain aspects of your risk profile have changed, allowing you to adjust your coverage accordingly. This proactive approach often leads to reductions in costs without sacrificing essential protections.

Additional Strategies for Savings

- Maintain a Good Credit Score: Many insurers consider credit ratings when determining premiums. A higher score can lead to lower costs.

- Participate in Safety Programs: Engaging in defensive driving courses or home safety programs may qualify you for discounts.

- Choose Higher Deductibles: Opting for a higher deductible can lower your premium, provided you have the financial capacity to cover the higher out-of-pocket expenses if a claim arises.

- Review Policy Annually: Regular assessments of your coverage and needs can help identify areas for potential savings.

Consulting with an insurance agent can provide additional insights into available discounts. Agents often have access to exclusive offers or can recommend strategies tailored to your specific circumstances.

Finally, consider loyalty programs or membership discounts from professional organizations, which can further enhance savings opportunities. Engaging with your insurer and asking about available options can lead to discovering hidden discounts.

Common Misconceptions About Extra Liability Coverage

Many individuals hold misconceptions regarding additional liability coverage, leading to confusion about its purpose and benefits. One prevalent myth is that this type of coverage is only for the wealthy or those who own significant assets. In reality, anyone can benefit from enhanced protection, regardless of their financial status. It serves as a safety net for unforeseen situations that may result in legal claims, making it a practical consideration for a wide range of individuals.

Another common misunderstanding is that this coverage is redundant if one already has home or auto insurance. While standard policies provide a baseline level of protection, they often fall short in high-stakes scenarios. Additional liability coverage acts as a supplementary layer, offering greater peace of mind and financial security in case of significant claims that exceed standard policy limits.

Key Misconceptions Explained

- Coverage Only for High-Income Individuals: This type of coverage is beneficial for anyone looking to protect their assets, not just the affluent.

- Redundant with Existing Insurance: It complements basic home and auto policies, providing extra financial protection.

- Only Covers Personal Injury: It extends beyond personal injury to include property damage and legal fees, broadening the scope of protection.

- Claims Are Difficult to File: Most claims are straightforward, and many find the process manageable with proper guidance.

Understanding these misconceptions can enhance your approach to financial safety. By recognizing the true purpose and advantages of additional liability coverage, individuals can make informed decisions that better protect their financial future.

Final Steps for Tailoring Your Coverage for Maximum Security

Assess the specific risks associated with your lifestyle and assets. This evaluation should include factors such as your profession, property values, and personal activities. Identifying these elements helps in determining the appropriate level of coverage needed.

Consult with an insurance expert to review your current protections. An experienced advisor can provide insights into potential gaps and suggest enhancements that align with your unique situation.

Key Actions to Enhance Your Protection

- Evaluate Your Assets: List all properties, vehicles, and other valuables. This will help determine the limit of coverage required to protect your wealth.

- Consider Future Changes: Anticipate any lifestyle changes, such as retirement or relocation, that may affect your risk profile.

- Review Existing Coverage: Examine your primary insurance plans. Ensure there are no overlaps or unnecessary redundancies.

- Adjust Coverage Limits: Set higher limits based on your financial situation and potential liabilities.

- Include Additional Coverages: Look into endorsements or riders that cover specific risks, such as personal injury or libel.

Regularly revisit and update your protections. Changes in your life circumstances or shifts in market conditions may necessitate adjustments to maintain optimal coverage.

By taking these steps, you can ensure a customized safety net that meets your needs and provides peace of mind.

Best rate umbrella policy

Features

| Part Number | 4810-2P |

| Color | White, Canary, Pink, Goldenrod |

| Size | Pack of 200 |

Video:

FAQ:

What is a best rate umbrella policy and how does it work?

A best rate umbrella policy is a type of insurance that provides additional liability coverage beyond the limits of your existing home, auto, or other personal insurance policies. Essentially, it acts as a safety net, covering claims that exceed the limits of your primary insurance. For example, if you have a car accident that leads to significant damages or injuries, and your auto insurance only covers up to a certain amount, the umbrella policy can cover the excess costs. This type of policy is beneficial because it often comes at a lower cost compared to increasing the liability limits on your primary policies. It can cover various scenarios, such as personal injury claims, property damage, and even legal fees, providing broader protection for your assets.

How can I find the best rate for an umbrella policy?

Finding the best rate for an umbrella policy involves several steps. First, it’s essential to compare quotes from multiple insurance providers. You can do this by contacting insurance agents or using online comparison tools. Be sure to consider the limits of coverage and the exclusions in each policy, as cheaper rates may not provide the same level of protection. Additionally, bundling your umbrella policy with other insurance types, such as auto or home insurance, often leads to discounts. Another factor to consider is your current liability coverage—ensuring that your underlying policies meet the minimum requirements set by the umbrella policy can help you secure a better rate. Finally, maintaining a good credit score can also positively impact your insurance premiums.

What factors can affect the cost of an umbrella policy?

Several factors can influence the cost of an umbrella policy. One major factor is the amount of coverage you choose. Higher coverage limits typically result in higher premiums. Your personal risk profile also plays a significant role; for instance, if you have a history of claims or risky behaviors, insurers may charge more. Additionally, where you live can affect your rates, as some areas may have higher crime rates or more lawsuits, leading to increased premiums. The underlying policies you have, such as auto and homeowner’s insurance, are also taken into account since they need to meet specific liability thresholds for the umbrella policy to kick in. Lastly, discounts for bundling policies or maintaining a good driving record can help lower costs.