Consider obtaining a liability policy that offers an extra layer of protection for your venture. This article explores the key features and benefits of such coverage, helping you make informed decisions tailored to your specific needs.

This guide is valuable for entrepreneurs and owners of various enterprises seeking to safeguard their assets against unforeseen liabilities. Whether you operate a consultancy, retail shop, or a service-oriented firm, understanding your coverage options can make a significant difference in your financial security.

You will find a breakdown of various providers, coverage limits, and pricing structures, along with practical tips for selecting the right policy. The insights shared here will empower you to protect your interests effectively while ensuring compliance with any legal requirements. Equip yourself with the knowledge to secure your venture against unexpected claims and lawsuits.

Best Small Business Umbrella Insurance

Choosing the right additional liability coverage can significantly enhance your protection against unforeseen events. This type of coverage serves as a safety net, extending beyond the limits of your primary policies, ensuring that your financial stability remains intact even in challenging situations.

When considering this type of coverage, evaluate your specific needs and potential risks associated with your operations. It is essential to assess factors such as the nature of your work, the size of your client base, and any contractual obligations that may require increased liability limits.

Key Factors to Consider

- Coverage Limits: Determine how much additional coverage you may require based on your existing policies and potential risks.

- Cost: Compare quotes from various providers to find a balance between affordability and adequate coverage.

- Exclusions: Review the policy exclusions to understand what is not covered, as this can impact your decision.

- Claims Process: Investigate the claims process of each provider, as a smooth and straightforward process is critical during stressful times.

It may also be beneficial to consult with an insurance expert who can help tailor a plan specific to your requirements. They can provide insights into industry standards and common pitfalls to avoid.

In conclusion, ensuring you have adequate coverage can safeguard against significant financial loss, making it a crucial aspect of risk management for any operation.

Understanding the Basics of Umbrella Insurance for Small Enterprises

For enterprises seeking additional protection, understanding supplemental coverage is key. This type of protection provides an extra layer beyond standard policies, addressing liabilities that may exceed the limits of primary coverage. This can be particularly useful for unforeseen incidents that could otherwise lead to significant financial setbacks.

It is essential to evaluate the specific risks associated with your operations. These risks may include personal injury claims, property damage, or even lawsuits stemming from professional services. By identifying potential vulnerabilities, you can better assess how this enhanced coverage fits into your overall risk management strategy.

Key Features of Supplemental Coverage

Supplemental protection typically offers broader coverage than standard policies. Here are some important features to consider:

- Higher Liability Limits: This coverage allows for increased liability limits, protecting your assets from large claims.

- Coverage for Multiple Areas: It often extends to various types of liabilities, including those not covered by your primary policies.

- Legal Defense Costs: This type of protection may cover legal fees associated with claims, further safeguarding your financial resources.

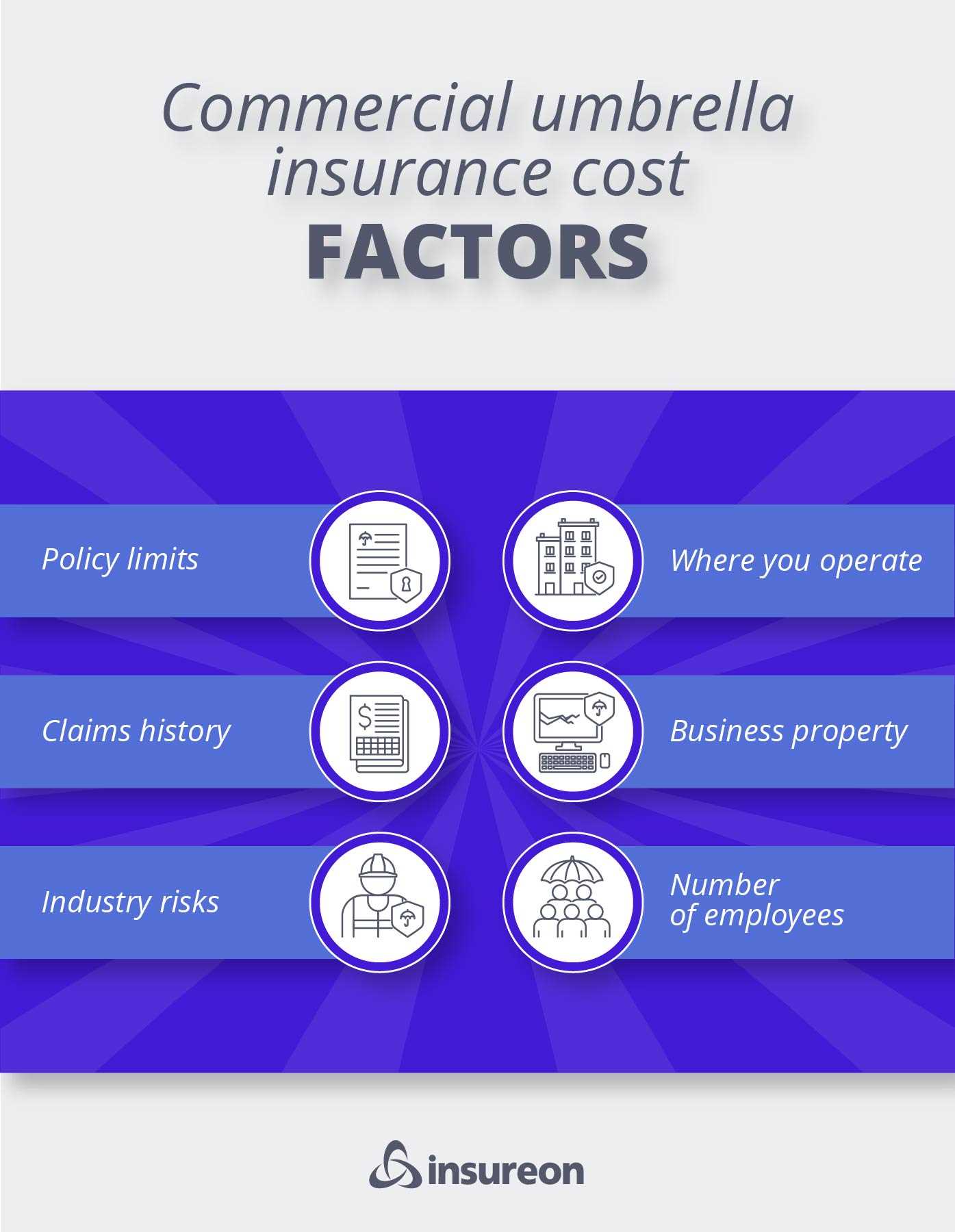

Evaluating the costs associated with this coverage is critical. Premiums can vary based on factors such as the nature of your operations, location, and the limits you choose. It’s advisable to compare quotes from different providers to ensure you obtain the most suitable option for your needs.

Incorporating this form of coverage into your risk management strategy can enhance your peace of mind, allowing you to focus on growth and development. By understanding the fundamentals, you empower yourself to make informed decisions that align with the unique requirements of your enterprise.

Key Benefits of Umbrella Coverage for Entrepreneurs

Having an additional layer of protection can safeguard your enterprise from unexpected legal and financial liabilities. This coverage kicks in when primary policies reach their limits, providing peace of mind and financial stability.

One of the standout features of this coverage is its broad scope. It covers various risks that may not be included in standard policies, such as libel, slander, or personal injury claims. This can help you avoid significant out-of-pocket expenses that could threaten your operations.

Financial Security

Financial security is a primary advantage of having this type of coverage. Lawsuits can be costly, not only in terms of legal fees but also in potential settlements. With adequate protection, you can mitigate these risks and ensure your enterprise remains financially viable.

Additionally, it enhances your credibility with clients and partners. When you have robust coverage, it demonstrates professionalism and responsibility, which can strengthen relationships and attract more business opportunities.

Peace of Mind

Peace of mind is invaluable for entrepreneurs. Knowing that you have an extra layer of protection allows you to focus more on growth and innovation rather than potential risks. This can lead to better decision-making and a more strategic approach to expanding your operations.

In summary, investing in this coverage is a proactive measure that can shield your enterprise from unforeseen challenges. By securing additional financial protection, you ensure your organization is well-equipped to handle liabilities while fostering growth and stability.

Choosing the Right Coverage Limits for Your Business Needs

Determining the appropriate coverage limits requires a careful assessment of specific risks associated with your operations. Begin by evaluating the potential liabilities your organization may face, which can vary significantly based on the industry and type of services provided.

Consider factors such as the size of your clientele, the nature of your products or services, and any contractual obligations that may increase your exposure. For instance, businesses that interact directly with customers or handle sensitive data may need higher limits compared to those with less direct engagement.

Assessing Your Risk Exposure

To accurately gauge your risk exposure, analyze past incidents within your field and consult with industry peers. This can provide insights into common claims and their costs. Additionally, consider conducting a risk assessment to identify vulnerabilities that could lead to significant financial loss.

It is advisable to review the following elements when determining coverage limits:

- Client Contracts: Review any agreements that stipulate liability requirements.

- Asset Value: Calculate total assets, including property, equipment, and inventory.

- Employee Count: Consider the number of employees, as more personnel can increase liability risks.

- Nature of Services: Assess the potential for claims based on the services you provide.

Once you have a clearer picture of your risk exposure, consider setting limits that not only cover potential claims but also protect against unforeseen circumstances. It may be beneficial to consult with an expert to tailor coverage that aligns with your specific needs.

Overall, selecting the right coverage limits is a critical step in safeguarding your assets and ensuring long-term stability. Regularly revisiting your coverage can help adapt to changes in your operations and the environment in which you operate.

Common Exclusions in Umbrella Policies

Understanding the exclusions in umbrella policies is critical for any entrepreneur. These exclusions can significantly impact coverage and financial protection. It is vital to review the specific terms of each policy to determine what is not included.

Common exclusions often encompass specific risks and liabilities that might not be covered under umbrella plans. These typically include:

Typical Exclusions

- Intentional Acts: Coverage does not extend to damages or injuries resulting from intentional or criminal actions.

- Contractual Liabilities: Obligations assumed under contracts may not be covered unless specifically included in the policy.

- Professional Services: Claims arising from professional advice or services might require separate coverage.

- Employment Practices: Issues related to employment practices, such as wrongful termination or discrimination, are often excluded.

- Personal Injury: Some policies may not cover claims for personal injuries, such as defamation or invasion of privacy.

It is prudent to discuss these exclusions with an agent to ensure the right protections are in place. Tailoring coverage to address specific risks can help mitigate unexpected liabilities.

How to Compare Different Umbrella Insurance Providers

To evaluate various providers of liability coverage, focus on key factors such as policy limits, exclusions, and customer service. Begin by obtaining quotes from multiple companies to understand the pricing structure and coverage options available. Each provider may offer unique features that can affect your decision.

Review the financial stability of each insurer by checking ratings from independent agencies. A solid financial rating indicates the company’s ability to pay claims, which is crucial for peace of mind. Additionally, assess their claims process; a streamlined, transparent procedure is often a sign of a reliable provider.

Key Factors for Comparison

- Coverage Options: Examine the specific coverage limits and what incidents are covered. Some policies may include gaps that could leave you vulnerable.

- Exclusions: Understand what is not covered under each policy. This can significantly impact your protection in case of a claim.

- Premiums: Compare the costs for similar coverage levels across different providers. Look for any hidden fees or discounts that could apply.

- Customer Service: Research reviews and ratings regarding each company’s customer support. Quick and helpful responses can save you time and frustration.

In addition to these factors, consider the reputation of each provider within the industry. A company with a long-standing history may offer more reliability than a newer entrant. Ultimately, selecting the right coverage involves careful analysis of these elements to ensure adequate protection for your needs.

Real-Life Scenarios Where Extra Coverage Saved Enterprises

In various instances, additional coverage has proven invaluable for numerous enterprises, safeguarding them from potentially devastating financial losses. Here’s a closer look at specific cases where this type of protection made a significant difference.

One notable case involved a landscaping service that faced a lawsuit after a client slipped and fell on their property. The claim exceeded the landscaping company’s primary coverage limits. However, their extra coverage stepped in to cover the remaining legal expenses, allowing the company to continue operations without facing bankruptcy. This instance highlights how crucial it is to have support beyond standard limits.

-

Retail Store Incident:

A customer slipped on a wet floor in a retail store, resulting in severe injuries. The store’s general liability coverage was insufficient to cover the total damages awarded by the court. Fortunately, their additional coverage helped absorb the excess costs, protecting the store from severe financial repercussions.

-

Restaurant Lawsuit:

A diner suffered food poisoning after eating at a local restaurant, leading to a lawsuit claiming damages. The case attracted significant media attention, leading to higher claims. The restaurant’s additional coverage provided essential funds to handle the legal costs and settlements, allowing the establishment to recover without crippling debt.

-

Construction Company Claim:

A construction firm faced a lawsuit after a worker was injured on the job site. The compensation awarded exceeded the company’s basic coverage limits. With the aid of extra coverage, the firm managed to pay the claim and maintain a positive reputation in the industry.

These scenarios illustrate the importance of having supplementary coverage to protect against unexpected liabilities. Without it, many enterprises could face severe financial strain or even closure following a significant claim. Investing in this type of protection is a prudent decision for any owner aiming to ensure long-term stability and resilience.

Best small business umbrella insurance

Features

| Is Adult Product | |

| Edition | 3 |

| Language | English |

| Number Of Pages | 800 |

| Publication Date | 2015-02-24T00:00:01Z |

Features

| Part Number | Refer to Sapnet. |

| Is Adult Product | |

| Release Date | 2020-10-14T00:00:01Z |

| Language | English |

| Number Of Pages | 295 |

| Publication Date | 2020-10-14T00:00:01Z |

Features

| Release Date | 2019-08-07T00:00:01Z |

| Edition | Illustrated |

| Language | English |

| Number Of Pages | 176 |

| Publication Date | 2019-08-07T00:00:01Z |

| Format | Illustrated |

Video:

FAQ:

What is small business umbrella insurance and why should I consider it?

Small business umbrella insurance is a type of liability insurance that provides additional coverage beyond the limits of your existing business insurance policies, such as general liability or commercial auto insurance. This coverage is particularly useful for small businesses that may face higher risks or potential lawsuits that could exceed standard policy limits. By having umbrella insurance, you can protect your business assets from significant financial losses due to legal claims, which can be especially important for small businesses that may not have extensive resources to cover unexpected expenses.

How much does small business umbrella insurance typically cost?

The cost of small business umbrella insurance can vary widely based on several factors, including the size of your business, the industry you operate in, the amount of coverage you choose, and your claims history. On average, small businesses might expect to pay anywhere from $400 to $2,000 annually for umbrella coverage. It’s advisable to obtain quotes from multiple insurance providers to find the best rates and coverage options for your specific business needs.

What types of claims does small business umbrella insurance cover?

Small business umbrella insurance typically covers a range of liability claims that may not be fully covered by your primary insurance policies. This can include claims related to bodily injury, property damage, personal injury, and certain legal costs, such as attorney fees and court costs. However, it’s important to note that umbrella insurance generally does not cover professional liability claims, employee injuries, or damage to your own property. Always review your policy details to understand the specific exclusions and limitations.

How can I determine the right amount of umbrella insurance for my business?

Determining the right amount of umbrella insurance for your business involves evaluating your current liability coverage and assessing the risks associated with your specific industry. A common approach is to consider the total value of your business assets and the potential financial impact of various risks you might face. It may also be helpful to consult with an insurance agent who can provide guidance based on your unique situation, helping you select a coverage limit that adequately protects your business without overextending your budget.