Choosing the right supplementary protection can significantly enhance your financial security. This article provides insights into the leading providers known for their outstanding offerings in this area. Whether you’re a homeowner, a renter, or someone who frequently travels, understanding these options can help you safeguard your assets against unforeseen events.

In this piece, I will explore various companies that excel in providing robust policies, highlighting their strengths, coverage limits, and customer satisfaction ratings. By the end of this article, you’ll have a clearer picture of which providers stand out in terms of value and reliability.

This information is particularly valuable for individuals seeking peace of mind through additional coverage or those looking to reassess their current plans. You’ll gain practical tips on selecting a provider that aligns with your specific needs and budget, ensuring that you make an informed decision.

Recommended Providers for Extra Liability Coverage

Choosing a reliable provider for additional liability coverage can significantly impact your financial security. It’s essential to research and compare various options to find one that meets your specific needs.

Consider the reputation and customer service of each company. Look for feedback from existing clients regarding claims processing and overall satisfaction. A strong track record in these areas can indicate a provider’s reliability and commitment to their clients.

Factors to Evaluate

- Financial Stability: Ensure the provider has a strong financial rating from agencies like A.M. Best or Standard & Poor’s. This indicates their ability to pay out claims.

- Coverage Options: Different providers offer varying levels of additional coverage. Evaluate the limits and exclusions to find a plan that aligns with your assets.

- Pricing: Compare quotes from multiple companies. Ensure you understand what is included in the premium and any potential discounts for bundling with other policies.

- Customer Support: Assess the accessibility and responsiveness of customer service, particularly regarding claims assistance.

Ultimately, the right choice will depend on individual circumstances and preferences. Conduct thorough research and consult with a trusted advisor to make an informed decision.

Key Features to Consider in an Additional Liability Policy

Prioritize coverage limits that exceed your existing policies. A robust liability policy should provide substantial protection against claims that surpass your standard home or auto coverage. Look for options that offer limits starting at one million dollars and potentially going up to five million or more, depending on your needs.

Examine the exclusions and specifics of what is covered. A comprehensive policy should include protection for various scenarios, such as personal injury claims, property damage, and certain legal fees. Ensure that the policy covers incidents occurring both on and off your property, as well as claims arising from activities involving family members.

Additional Considerations

- Underlying Policies: Check if the policy requires certain underlying coverage levels in your primary policies. This can impact your ability to claim effectively.

- Legal Defense Costs: Confirm if the legal defense costs are included within the coverage limits or if they are provided in addition to the coverage amount.

- Worldwide Coverage: Some options include coverage for incidents occurring outside of the country, which is particularly beneficial for frequent travelers.

- Personal Injury Protection: Ensure that the policy includes coverage for libel, slander, and other personal injury claims that might arise.

Evaluate the claims process and customer service reputation of the provider. A straightforward claims process can save time and reduce stress during challenging situations. Research reviews and ratings to gauge the experiences of other policyholders.

Finally, consider the flexibility of the policy. The ability to adjust coverage limits or add endorsements as your circumstances change can provide peace of mind in an unpredictable environment.

Comparative Analysis of Leading Insurance Providers

Evaluating the offerings of various providers is essential for informed decision-making. Certain companies stand out for their robust coverage options, customer service, and pricing structures.

Customer satisfaction plays a pivotal role in choosing an appropriate provider. Reviews and ratings from existing clients can reveal strengths and weaknesses in their service. A closer look at claims handling and responsiveness can also indicate the reliability of a provider’s support.

Key Factors in Provider Evaluation

- Coverage Limits: Different entities offer a range of coverage limits, which can significantly impact protection levels.

- Pricing: Premiums vary widely; understanding the factors that influence costs can lead to better choices.

- Exclusions: Each provider has unique exclusions which are critical to review, as they define what is not covered.

- Claims Process: A streamlined claims process can significantly enhance the experience during challenging times.

- Discounts: Some companies provide discounts for bundling policies or for maintaining a clean record, which can lower overall costs.

It’s beneficial to compare multiple providers based on these aspects. Gathering quotes and analyzing coverage details can help in selecting a plan that aligns with specific needs and budgets.

| Provider | Coverage Limit | Average Premium | Customer Rating |

|---|---|---|---|

| Provider A | $1 million | $150 | 4.5/5 |

| Provider B | $2 million | $200 | 4.2/5 |

| Provider C | $1 million | $175 | 4.7/5 |

In conclusion, assessing key features and client feedback can lead to the selection of a provider that offers the best combination of value and protection.

Pricing Structures: Understanding Costs of Umbrella Coverage

Understanding the pricing structures associated with additional liability protection is essential for making informed decisions. Various factors influence the costs, including the amount of coverage desired, the insured’s risk profile, and the underlying policies held.

Premiums typically range based on the coverage limit. Higher limits generally result in increased costs, but the incremental expense may be minimal compared to the enhanced protection provided. Insurers often base their rates on personal risk factors such as property value, location, and claims history.

Factors Influencing Premiums

- Coverage Amount: The higher the limit, the higher the cost. Assessing personal needs can help determine the appropriate level of coverage.

- Underlying Policies: Maintaining robust primary liability policies can lead to lower premiums on additional coverage. Insurers often require specific minimums for these primary policies.

- Claims History: A history of claims can increase premiums. Insurers may view this as a sign of higher risk.

- Location: Geographic factors, including crime rates and natural disaster risks, can affect costs. Areas prone to litigation may also see higher rates.

- Personal Assets: Individuals with significant assets may face higher premiums due to the increased risk of substantial claims.

Most providers offer discounts for bundled policies, encouraging clients to consolidate their coverage. This can lead to significant savings compared to purchasing each policy separately.

Understanding these elements can empower individuals to evaluate their options effectively and select a plan that aligns with their financial situation and risk exposure.

Customer Service Ratings and Support Options

Evaluating customer service ratings is essential for anyone considering additional coverage. High ratings indicate a commitment to client satisfaction, which can significantly impact the overall experience during claims and support interactions.

Many providers offer multiple support options, allowing clients to choose the method that suits them best. This can include phone support, online chat, and email communication. Some companies also provide mobile apps for easy access to policy information and customer service.

Key Aspects of Customer Support

- Response Time: Quick responses to inquiries are a hallmark of reliable service. Look for companies that prioritize prompt communication.

- Availability: Support hours can vary, with some offering 24/7 service while others operate during standard business hours.

- Online Resources: A comprehensive FAQ section, educational articles, and user-friendly websites enhance customer experience.

- Claims Process: Transparency and efficiency in handling claims are critical. Providers with straightforward processes tend to receive higher ratings.

Researching reviews from current and former clients can provide insight into the reliability of support options. Consistent feedback regarding responsiveness and helpfulness will guide decisions effectively.

Consideration of these factors will ensure that you choose a provider that aligns with your expectations for customer service and support.

Claims Process: Efficiency and User Experience

Understanding the claims process is critical for policyholders. A streamlined approach can significantly enhance user satisfaction and reduce stress during what can be a challenging time. Look for companies that prioritize clarity in their procedures and provide multiple channels for submitting claims.

First, evaluate the accessibility of the claims process. A user-friendly online platform can facilitate quicker submissions and status updates. Ensure that the provider offers clear guidelines and FAQs to help navigate the process. Additionally, having dedicated customer support available through various means, such as phone, chat, or email, can make a considerable difference in user experience.

Key Elements of Claims Processing

- Transparency: Clear communication regarding the steps, timelines, and required documentation is essential.

- Speed: A prompt acknowledgment of the claim submission can set a positive tone for the entire process.

- Flexibility: Options for submitting claims via app, website, or in-person can cater to different user preferences.

- Follow-up: Regular updates about the status of the claim can alleviate anxiety and improve satisfaction.

By focusing on these elements, companies can create a more satisfying experience for their clients. A well-designed claims process not only enhances user experience but also reflects positively on the overall reputation of the provider.

In summary, when evaluating options, consider how each provider approaches the claims process. A commitment to efficiency and user-centric practices can significantly impact your overall satisfaction.

Real-Life Customer Testimonials and Case Studies

Customer experiences provide valuable insights into the reliability of various providers. Individuals who have utilized personal liability coverage often share how it has impacted their lives during unforeseen events.

For instance, Sarah, a homeowner in California, faced a lawsuit after a guest was injured at her property. Her policy, with a reputable provider, offered a seamless claims process, covering legal fees and settlements. “I felt secure knowing I had the backing of my provider,” she stated, highlighting the peace of mind that came with her coverage.

-

Mark’s Experience:

During a family gathering, a tree branch fell and damaged a neighbor’s car. Mark’s coverage handled the damages without hassle. “I never thought I would need it, but it saved me from a financial burden,” he shared.

-

Lisa’s Case:

After a slip-and-fall incident at her rental property, Lisa was relieved her policy covered the legal ramifications. “The support staff were responsive and guided me through the process,” she remarked.

-

John’s Insight:

Following a dog bite incident, John praised his provider for their quick response. “They took care of everything, and I didn’t have to worry about a thing,” he noted.

These testimonials underscore the importance of selecting a provider based on customer service quality and claims handling. Researching real-life experiences can guide potential policyholders in making informed decisions.

Best umbrella insurance carriers

Video:

FAQ:

What is umbrella insurance and why should I consider it?

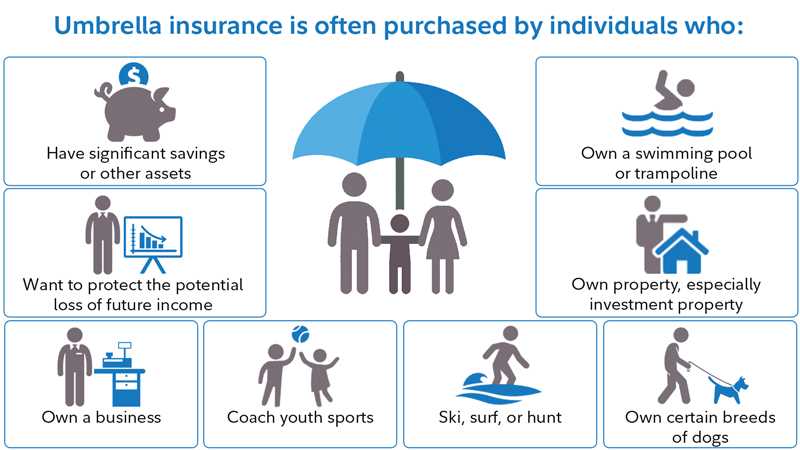

Umbrella insurance provides additional liability coverage beyond the limits of your standard policies, such as homeowners or auto insurance. It helps protect your assets in the event of major claims or lawsuits. If you face a significant lawsuit, your existing policies may not cover all damages, leaving you vulnerable. Umbrella insurance acts as a safety net, covering legal fees and settlements, which can be especially important for individuals with substantial assets or income. It’s a smart choice for anyone looking to enhance their financial security.

How do I choose the best umbrella insurance carrier for my needs?

Choosing the right umbrella insurance carrier involves several steps. First, assess your current insurance policies to determine how much additional liability coverage you need. Research various carriers by comparing their financial stability and customer reviews. Look for companies that offer flexible policy limits and affordable premiums. You may also want to consult with an insurance agent who can provide personalized recommendations based on your specific circumstances and help you understand the terms of each policy. It’s important to choose a carrier that is reliable and has a good reputation for customer service.

What factors affect the cost of umbrella insurance premiums?

The cost of umbrella insurance premiums can vary based on several factors. Key considerations include your location, the amount of coverage you choose, and your personal risk profile. If you have multiple policies with the same insurer, you may qualify for discounts. Additionally, your claims history and the types of assets you wish to protect can impact your premium rates. Generally, the more assets you have to protect, the higher your coverage limits will be, which can lead to increased premiums. It’s advisable to get quotes from multiple carriers to find the best rate for your coverage needs.

Are there any exclusions I should be aware of with umbrella insurance policies?

Yes, umbrella insurance policies often come with specific exclusions that you should be aware of. Common exclusions include claims related to personal injuries, business activities, and intentional acts. For instance, if you are sued for defamation or have a claim related to a business you own, your umbrella policy may not cover those situations. Additionally, certain types of liability, such as those stemming from vehicles not covered under your auto insurance, may also be excluded. Always read the policy details carefully and ask your insurer about any uncertainties to ensure you have a clear understanding of what is covered and what is not.