Choosing the right policy for supplementary liability coverage can significantly enhance your financial security. This article outlines several leading options available, emphasizing their key features, pricing, and suitability for various lifestyles.

This guide is aimed at individuals seeking to bolster their existing coverage, whether for personal assets, rental properties, or recreational activities. You’ll find a comparison of policies that cater to different needs and budgets, providing you with a clear understanding of what each option offers.

In summary, the article provides a detailed analysis of the most reputable providers, their coverage limits, and unique benefits. You’ll learn how to select the best fit for your circumstances, ensuring comprehensive protection against unforeseen events that could impact your financial stability.

Best Coverage for Personal Liability Protection

Secure a policy that provides extensive liability coverage beyond standard limits of home or auto plans. This type of protection is essential for safeguarding personal assets against claims resulting from accidents or injuries that occur on your property or due to your actions.

When selecting a suitable policy, assess the coverage limits and ensure they align with your financial situation and potential risks. Policies typically offer coverage starting from one million dollars, which can be increased based on individual needs and circumstances.

Factors to Consider

- Coverage Amount: Evaluate how much liability coverage you may need based on your net worth and lifestyle.

- Policy Exclusions: Review exclusions carefully to understand what is not covered and consider additional policies if necessary.

- Cost: Compare premiums from various providers while considering the coverage benefits offered.

- Provider Reputation: Research customer reviews and ratings to ensure the insurer has a solid track record in claims handling.

- Legal Defense Costs: Ensure the policy covers legal fees associated with defending against claims, as these can be substantial.

Consult with an insurance agent who specializes in this type of protection to tailor a plan that meets your specific needs. This can help identify potential risks in your lifestyle that may require additional coverage.

Regularly review your policy to adjust coverage as your circumstances change, such as significant purchases or changes in personal status. Staying proactive in managing your liability protection can prevent unforeseen financial difficulties.

Understanding the Need for Umbrella Coverage

Having additional protection beyond standard policies can significantly safeguard personal assets. This type of coverage acts as a financial buffer, protecting individuals from large claims that exceed their primary policy limits.

Many underestimate the potential risks associated with everyday activities. A serious accident or legal dispute can lead to substantial financial repercussions, making it essential to consider extra coverage that can handle such situations.

Why Extra Protection Matters

Every person faces unique risks that can lead to costly liabilities. Here are a few reasons why considering this additional layer of protection is wise:

- Legal Defense Costs: Standard policies may not cover all legal expenses. This protection can help cover attorney fees and court costs.

- Asset Protection: With increasing litigation, safeguarding personal assets from claims is vital.

- Peace of Mind: Knowing there is extra coverage can reduce stress in potentially harmful situations.

In some cases, the cost of this protection is minimal compared to the financial risk involved. Evaluating personal circumstances, such as property value and assets, can help determine the appropriate level of coverage needed.

Assessing risks and understanding potential financial impacts can lead to informed decisions. Engaging with an expert can provide tailored advice based on specific lifestyles and needs.

Key Features to Look for in Umbrella Policies

When considering additional liability coverage, certain attributes can enhance the protection provided. A thorough understanding of these features will help individuals make informed decisions about their financial security.

One significant aspect is the extent of coverage. Policies should offer a high coverage limit, typically starting at a million dollars and extending to several million. This ensures adequate protection against severe claims that may exceed standard limits. Additionally, it’s prudent to check the types of incidents covered, as each policy may vary in its inclusivity regarding personal and property liabilities.

Factors to Evaluate

- Exclusions: Review any exclusions carefully. Some policies may not cover certain activities or incidents, such as specific types of business-related liabilities.

- Underlying Limits: Ensure that the primary policies, like homeowner or auto, meet the minimum required limits to activate the additional coverage.

- Legal Defense Costs: Some plans may cover legal fees, while others may not. Clarifying this aspect is essential, as legal costs can accumulate rapidly.

- Worldwide Coverage: Assess if the policy provides protection for incidents that occur outside the country. This is particularly relevant for travelers or those living abroad.

- Premium Costs: Compare premium rates across different providers. While lower costs may seem attractive, the coverage details are equally important to consider.

By focusing on these features, individuals can ensure that their liability protection is robust and tailored to their specific needs.

Providers Offering Liability Coverage for Personal Assets

Several companies specialize in liability protection, providing substantial coverage limits and various options tailored to personal needs. These firms often offer competitive pricing and discounts when bundled with other types of policies, making them attractive choices for safeguarding assets against unforeseen events.

Research indicates that customer service ratings, claims handling efficiency, and policy customization are critical factors when selecting a provider. Prospective policyholders should compare multiple quotes and examine specific terms to identify the most suitable coverage for their circumstances.

Leading Companies in the Market

- Provider A: Known for its extensive network of agents and quick claim processing, this firm is favored by many for its customer-centric approach.

- Provider B: Offers flexible policy options and substantial discounts for bundling, making it a popular choice among homeowners.

- Provider C: Renowned for its robust financial stability and high customer satisfaction ratings, this company provides a reliable safety net.

Evaluating each company’s reputation and financial strength is crucial. Additionally, consider how claims processes are handled and whether they provide personalized support throughout the coverage period.

- Assess your existing coverage to determine additional limits required.

- Request quotes from at least three different providers.

- Review policy details thoroughly for exclusions or limitations.

- Check customer reviews and industry ratings for insights on service quality.

| Provider | Coverage Options | Discounts Available |

|---|---|---|

| Provider A | Up to $5 million | Bundling, loyalty |

| Provider B | Up to $10 million | Multi-policy |

| Provider C | Up to $3 million | Referral |

Choosing the right provider involves careful consideration of your unique situation and potential risks. Ensure that the selected company aligns with your financial goals and provides the necessary protection against liabilities.

Cost Factors Influencing Umbrella Insurance Premiums

The premium for additional liability coverage varies significantly based on a multitude of factors. Understanding these elements can help you make informed decisions when selecting coverage. Key considerations include personal risk exposure, geographical location, and existing policies.

One primary factor influencing the cost is the level of coverage desired. Higher limits typically result in increased premiums. Additionally, an individual’s lifestyle choices, such as owning high-value assets or engaging in activities that could lead to higher liability risks, play a crucial role in determining the cost.

Key Influencing Factors

- Personal Assets: The more assets you have, the higher the potential payout in a liability claim, which can lead to increased premium costs.

- Location: Areas with higher crime rates or more lawsuits tend to have higher premiums due to increased risk.

- Claims History: A history of claims can raise premiums, as insurers may view you as a higher risk.

- Existing Coverage: Bundling this additional liability with other types of coverage can sometimes lower overall costs.

- Age and Experience: Younger individuals or those with less experience may face higher rates due to perceived risk factors.

In summary, carefully evaluating these factors can aid in choosing the right level of protection while managing costs effectively. Consulting with an expert can also provide personalized insights based on your unique circumstances.

Real-Life Scenarios Highlighting the Importance of Extra Coverage

Consider the case of a homeowner who hosts a party. A guest accidentally trips over a loose wire and sustains a serious injury, resulting in medical bills exceeding $200,000. Without sufficient additional protection, the homeowner could be held liable for these costs, jeopardizing their financial stability.

Another example involves a driver who causes an accident that injures several people. The total claim could surpass one million dollars. In such a situation, standard car coverage might not cover the entire amount, leaving the driver responsible for the difference. This can lead to severe financial repercussions.

These scenarios illustrate the potential risks individuals face daily. Investing in additional coverage provides a safety net, protecting against unforeseen liabilities.

- Host Liability: A guest suffers an injury at your residence.

- Automobile Accidents: Causing damage or injury that exceeds standard policy limits.

- Rental Property Issues: A tenant files a lawsuit due to negligence leading to injury.

- Defamation Cases: A social media post results in reputational damage and legal claims.

- Dog Bites: An incident involving your pet could lead to significant liabilities.

| Scenario | Potential Costs |

|---|---|

| Injury at Home | $200,000+ |

| Car Accident | $1,000,000+ |

| Rental Liability | $500,000+ |

| Defamation Claim | $300,000+ |

| Dog Bite Incident | $100,000+ |

Ultimately, securing additional coverage offers peace of mind against substantial financial risks. Without it, individuals may face overwhelming costs from unforeseen events that could lead to significant debt or loss of assets.

Best umbrella insurance for individuals

Features

| Release Date | 2021-10-08T00:00:00.000Z |

| Edition | 5 |

| Language | English |

| Number Of Pages | 2025 |

| Publication Date | 2021-10-08T00:00:00.000Z |

| Format | Kindle eBook |

Video:

FAQ:

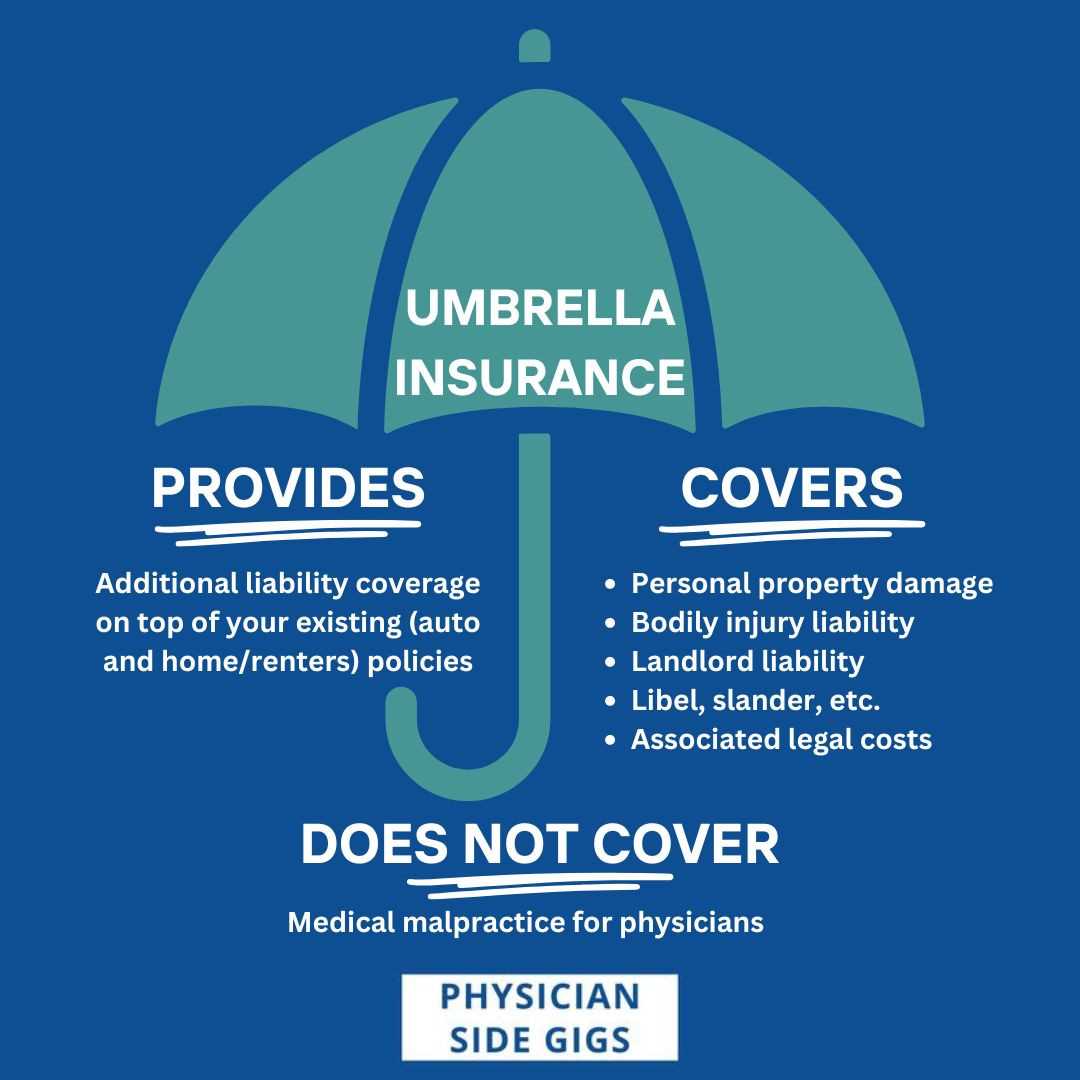

What is umbrella insurance and why might I need it?

Umbrella insurance is a type of liability insurance that provides additional coverage beyond what your standard policies, such as auto or homeowners insurance, offer. It acts as a financial safety net in case you face a lawsuit or significant claims that exceed the limits of your other insurance policies. Individuals might consider this coverage if they have substantial assets to protect or if they are at a higher risk of being sued, such as those with public profiles or frequent social activities.

How do I determine the right amount of umbrella insurance for my needs?

To find the appropriate amount of umbrella insurance, evaluate your assets, income, and potential risks. Start by calculating your total net worth, including savings, investments, and property. Consider your lifestyle, such as whether you host gatherings or engage in activities that could lead to accidents. It’s common for individuals to choose coverage limits starting at $1 million, but higher amounts may be necessary depending on your situation. Consulting with a financial advisor or insurance agent can provide tailored recommendations.

Are there specific exclusions I should be aware of with umbrella insurance policies?

Yes, umbrella insurance policies often have exclusions that are important to understand. Common exclusions include claims arising from business activities, intentional harm, or certain types of personal injury, such as slander or libel, unless specified otherwise. Additionally, damages resulting from car accidents may not be covered if they exceed auto insurance limits. It’s essential to read the policy details carefully and clarify any uncertainties with your insurance provider to ensure you have the necessary coverage.

Can I purchase umbrella insurance from any insurance provider?

Most insurance companies offer umbrella insurance, but eligibility may depend on holding specific underlying policies, like auto or homeowners insurance, with the same provider. It’s advisable to compare quotes and coverage options from multiple insurers to find the best fit for your needs. Check for any discounts that may apply, especially if you already have other policies with the same company. Always review the terms and conditions of the policies to ensure comprehensive coverage.

How much does umbrella insurance typically cost?

The cost of umbrella insurance can vary widely based on factors such as the amount of coverage you choose, your location, and your risk profile. On average, a policy may cost between $150 to $300 annually for $1 million in coverage. Higher coverage limits will generally lead to increased premiums. It’s wise to obtain quotes from different providers and consider any discounts that may apply if you bundle this insurance with other policies. Investing in umbrella insurance can provide significant peace of mind for relatively low annual costs.