When it comes to safeguarding your investment properties, having adequate coverage is non-negotiable. This article outlines the top options available to enhance your existing policies and provide additional protection against unexpected liabilities. You’ll discover how these supplemental plans can shield you from financial losses that could arise from tenant actions or accidents on your premises.

This guide is tailored for landlords, property managers, and real estate investors seeking peace of mind and financial security. By understanding the nuances of various coverage types, you can make informed decisions that align with your risk tolerance and financial goals.

Within this article, you’ll find detailed comparisons of leading providers, insights into policy limits, and tips for maximizing your coverage. With the right information, you can confidently select the best fit for your unique situation, ensuring that your assets are well protected.

Optimal Coverage for Rental Ventures

Acquiring additional coverage for your leasing endeavors can significantly mitigate financial risks associated with unforeseen events. This protection can safeguard your assets from various liabilities, ensuring that your investments remain secure against legal claims or accidents that may occur on the premises.

Choosing the appropriate policy involves evaluating several factors that can influence the scope of coverage. Focus on aspects such as limits of liability, exclusions, and premium costs to find a solution that meets your unique requirements.

Key Factors to Consider

- Liability Limits: Assess the amount of coverage you may need based on the value of your assets and potential risks. Higher limits offer greater peace of mind.

- Coverage Scope: Look for policies that include a wide range of incidents, such as bodily injury, property damage, and personal injury claims.

- Exclusions: Thoroughly review what is not covered. Understanding exclusions helps prevent unexpected gaps in protection.

- Premium Costs: Compare premiums among different providers. Lower costs may not always equate to adequate coverage, so balance affordability with quality.

When exploring options, consider consulting with an insurance broker who specializes in real estate. This professional can provide tailored advice based on your specific situation, ensuring that you make informed choices about your coverage.

Finally, regularly review your policy to adapt to any changes in your rental portfolio or the legal landscape. Adjusting your coverage in response to new risks can enhance your financial security and protect your investments more effectively.

Understanding Umbrella Coverage for Landlords

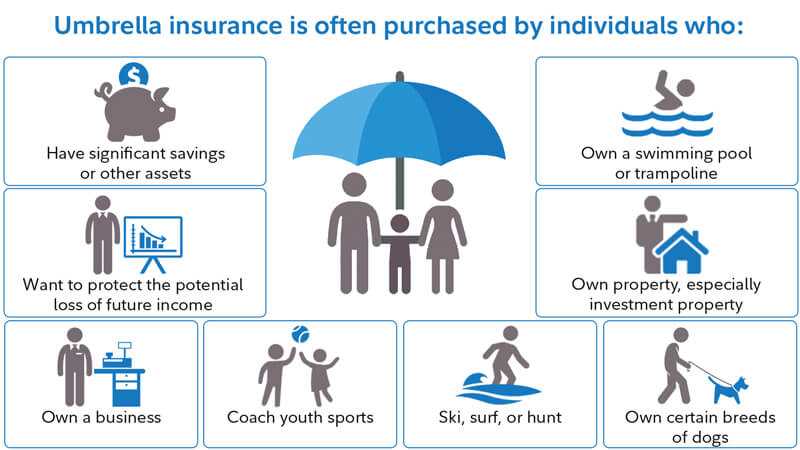

Landlords should consider acquiring additional coverage that extends beyond standard liability options. This type of protection provides a safety net against significant claims that could exceed the limits of primary policies, safeguarding personal assets.

The primary advantage of this coverage lies in its ability to cover a range of scenarios, including incidents involving tenants or visitors. It can also protect against claims related to property damage and personal injury that go beyond typical limits.

Key Benefits of Extra Liability Protection

- Higher Coverage Limits: Offers increased financial protection for claims that surpass the limits of existing policies.

- Broader Scope: Covers various incidents, including those that may not be included in standard landlord coverage.

- Asset Protection: Shields personal assets from potential lawsuits and claims.

Understanding the nuances of this additional coverage is crucial. It typically kicks in after the limits of primary liability coverage have been exhausted. Therefore, it is essential to evaluate existing coverage limits to determine how much additional protection is necessary.

Landlords should also assess their specific risks. Factors such as property location, tenant demographics, and property type can influence the level of risk exposure. Consulting with an expert in this field can provide tailored insights and recommendations.

Key Features to Look for in Rental Property Coverage

When selecting coverage for your rental assets, focus on several critical aspects that can significantly impact your financial security. The right policy will not only protect your investment but also provide peace of mind against unforeseen events.

One of the primary elements to consider is liability protection. This feature safeguards you against legal claims arising from injuries or damages occurring on your premises. Ensure that the policy provides adequate limits that align with the potential risks associated with your property.

Additional Features to Consider

Another important aspect is coverage for property damage. Look for provisions that encompass various risks, including fire, theft, vandalism, and natural disasters. A comprehensive policy will help you recover costs associated with repairs or replacements.

Additionally, assess the policy’s terms regarding loss of rental income. In case your property becomes uninhabitable due to a covered peril, you should be compensated for the income lost during the repair period. This can be a crucial safety net for landlords.

- Personal Property Coverage: Ensure the policy includes protection for furniture and appliances in your rental unit.

- Legal Expense Coverage: Consider policies that cover legal fees related to tenant disputes or evictions.

- Deductible Options: Evaluate various deductible amounts to find a balance between premium costs and out-of-pocket expenses during a claim.

Lastly, always review the exclusions in the policy. Understanding what is not covered will help you avoid surprises in the event of a claim. Look for options to add endorsements for specific risks that may be relevant to your situation.

Leading Providers of Liability Coverage for Real Estate Investors

When selecting a provider for additional liability coverage, real estate investors should prioritize companies known for their robust offerings tailored to property owners. Certain firms stand out due to their expertise in the real estate sector and their ability to accommodate diverse investment portfolios.

Some of the most reputable names in the market provide specialized plans that address unique risks associated with real estate. These organizations typically offer flexible options that allow investors to customize their coverage based on property types, geographic locations, and specific investment strategies.

Key Attributes of Reliable Providers

- Experience: Look for firms with a long-standing history in the real estate market, as they are more likely to understand the nuances of property management and investment.

- Customer Service: Quality support is vital. Providers with dedicated customer service teams can address inquiries and claims more effectively.

- Financial Stability: Companies with strong financial ratings are more trustworthy, ensuring they can meet their obligations in the event of a claim.

- Customizable Policies: The ability to tailor coverage to specific needs enhances protection against potential liabilities.

Investors should also evaluate the claims process. A streamlined procedure can save time and reduce stress during critical moments. Some providers offer online platforms for managing claims, which can enhance convenience and transparency.

Furthermore, consider the availability of additional resources, such as risk assessment tools and educational materials. These can assist property owners in identifying potential hazards and enhancing their overall risk management strategies.

| Provider | Experience (Years) | Financial Rating | Custom Options |

|---|---|---|---|

| Provider A | 30 | A+ | Yes |

| Provider B | 25 | A | Yes |

| Provider C | 20 | A- | No |

Cost Considerations and Premium Comparison for Rental Properties

Determining the right financial protection for your rental assets requires careful evaluation of costs and premium rates. Prioritize obtaining quotes from multiple providers to ensure competitive pricing. This strategy enhances your ability to find the most suitable coverage tailored to your specific needs.

Factors influencing premium rates include property location, size, and the level of coverage. Regularly reviewing your policy can also help identify opportunities for savings or necessary adjustments based on changes in your rental activities.

Key Cost Factors

- Property Value: Higher valued assets typically incur higher premiums.

- Rental History: Properties with a history of claims may attract higher rates.

- Location: Areas prone to natural disasters or crime can lead to increased costs.

- Deductibles: Higher deductibles often lower the premium but increase out-of-pocket expenses when a claim arises.

- Coverage Limits: Adjusting coverage limits will directly impact premium costs.

Premium Comparison Table

| Provider | Annual Premium ($) | Coverage Limit ($) | Deductible ($) |

|---|---|---|---|

| Provider A | 500 | 1,000,000 | 1,000 |

| Provider B | 600 | 1,000,000 | 500 |

| Provider C | 450 | 1,000,000 | 1,500 |

By assessing the data presented in the table and factoring in your unique circumstances, you can make an informed decision. Consider negotiating with providers to achieve a better rate while ensuring adequate coverage. Regular reviews of your protection plan can help maintain cost-effectiveness and relevance to your rental strategy.

Best umbrella insurance for rental properties

Video:

FAQ:

What should I look for in umbrella insurance for my rental properties?

When selecting umbrella insurance for rental properties, consider several key factors. First, assess the coverage limits. Umbrella insurance typically provides liability coverage beyond your existing policies, so ensure that the limits are sufficient to protect your assets. Second, evaluate the types of incidents covered. Look for a policy that includes coverage for bodily injury, property damage, and personal injury claims. Third, review the exclusions in the policy. Understanding what is not covered can help you avoid potential pitfalls. Lastly, consider the cost of the premium in relation to the coverage it offers. It’s important to find a balance between affordability and adequate protection.

How does umbrella insurance benefit rental property owners?

Umbrella insurance offers significant benefits for rental property owners by providing an additional layer of liability protection. For instance, if a tenant or visitor is injured on your property and files a lawsuit, your standard landlord insurance might not cover all the costs, especially if the damages exceed your policy limits. In such cases, umbrella insurance can cover the excess liability, protecting your personal assets, such as savings and investments. Additionally, this type of insurance can cover legal fees, which can be substantial in lawsuits. Overall, umbrella insurance is a cost-effective way to ensure you have comprehensive liability protection, helping you manage risks associated with owning rental properties more effectively.