If you’re seeking additional protection against unexpected incidents, exploring coverage options is essential. This article outlines the leading providers in Ashland Heights that offer enhanced protection for your assets. You’ll find valuable insights into various options, pricing, and customer feedback that can guide your decision-making process.

This piece is tailored for individuals and families looking to safeguard their financial well-being. Whether you are a homeowner, renter, or business owner, understanding these offerings can help you make informed choices that align with your specific needs.

Within the article, you’ll discover a detailed comparison of different providers, highlighting their coverage limits, premium costs, and customer service ratings. Key tips on what to look for when selecting a provider are also included, ensuring you have the necessary information to choose wisely. Explore your options and secure peace of mind with the right coverage today.

Recommended Coverage Solutions in Ashland Heights

For residents seeking comprehensive protection beyond standard policies, various providers in the area specialize in offering extended coverage options. These solutions serve to safeguard assets against unforeseen events that could lead to significant financial loss.

Researching local firms that focus on these supplementary protections can yield favorable results. It is advisable to compare services and seek recommendations from community members who have utilized similar offerings. This approach ensures informed decisions tailored to individual needs.

Key Features to Look For

- Financial Stability: Choose providers with solid financial ratings to ensure reliability in claims settlement.

- Customer Service: Evaluate responsiveness and support options available for clients.

- Coverage Limits: Understand the maximum protection levels offered, which can vary significantly.

- Exclusions: Review any limitations or conditions that may affect claims.

Engaging with local representatives can provide insights into personalized coverage options tailored to unique situations. A thorough understanding of available choices empowers individuals to make sound financial decisions regarding their protective measures.

Consider reviewing testimonials and case studies from existing clients. This feedback can highlight the strengths and weaknesses of each provider, aiding in the selection process.

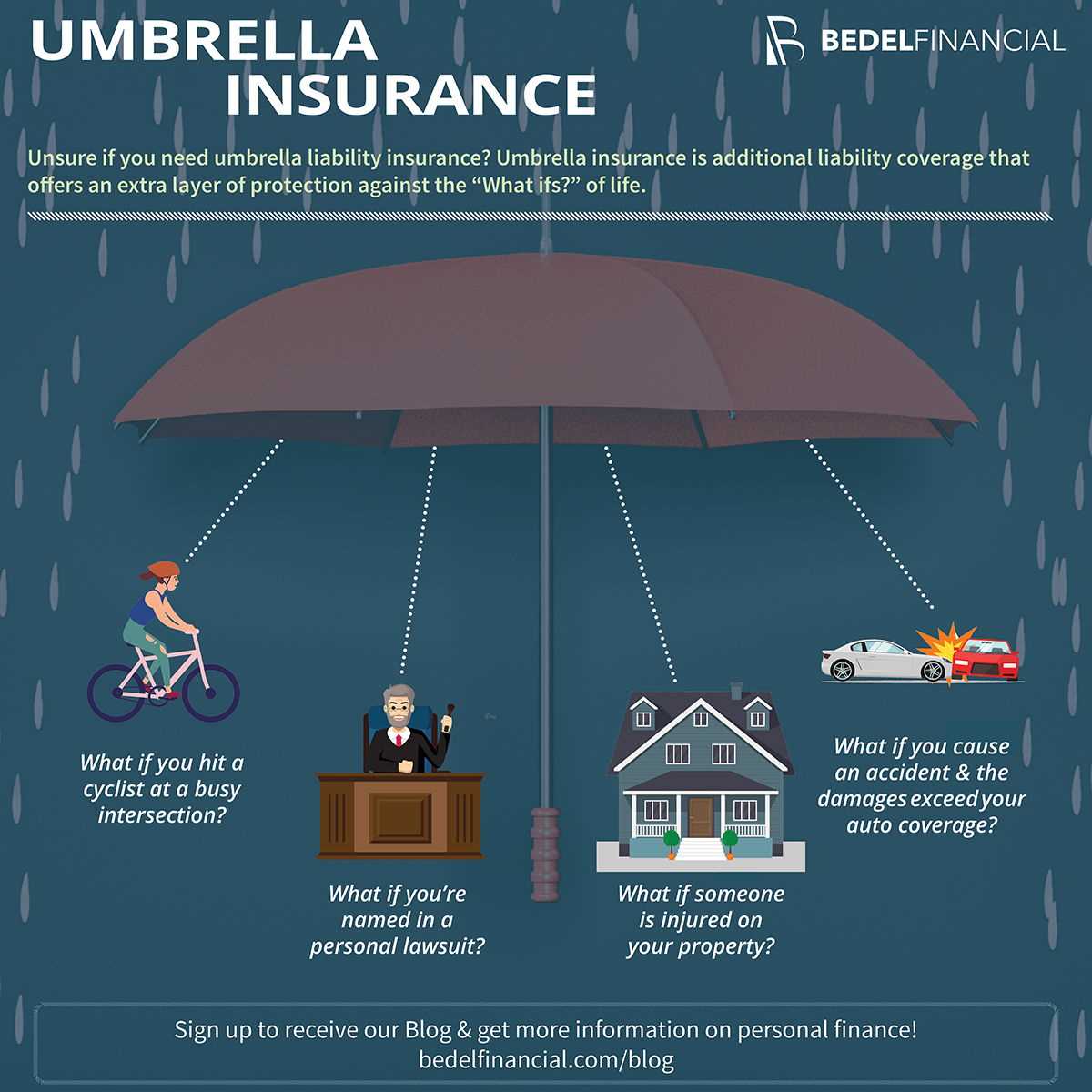

Understanding Umbrella Liability Insurance Coverage

Choosing the right coverage can significantly enhance your financial protection. This type of policy provides an extra layer of security, extending beyond standard protections, and can be crucial for safeguarding personal assets.

Common scenarios where this coverage becomes beneficial include situations involving severe accidents or incidents leading to lawsuits. It is designed to cover costs that exceed the limits of your primary policies, such as auto or homeowner’s coverage. Understanding the specifics can help you make informed decisions about your protection needs.

Key Features of Enhanced Coverage

Policies generally include coverage for various types of incidents, including:

- Personal injury claims against you.

- Property damage caused by you or a family member.

- Legal defense costs in case of lawsuits.

It is crucial to assess your risk exposure, as higher limits can provide greater peace of mind. Consider factors such as:

- Your assets and net worth.

- Your lifestyle and activities that may pose risks.

- The presence of pools, trampolines, or pets that could increase liability.

Consulting with an expert can clarify coverage limits and exclusions, ensuring you select a policy that aligns with your unique circumstances. To maximize benefits, keep track of any changes in your assets or activities that might affect your coverage needs.

Reasons to Choose Ashland Heights for Insurance Needs

Choosing a reliable provider for protecting your assets and ensuring peace of mind is paramount. Ashland Heights stands out due to its commitment to personalized service and extensive knowledge of the local market.

The agency offers tailored solutions that fit individual requirements, helping clients navigate the complexities of coverage options. Their experienced team actively engages with clients to assess unique situations, ensuring that every aspect of protection is addressed.

Unmatched Customer Support

Exceptional customer support is a hallmark of the agency. Clients receive ongoing assistance, from initial inquiries to policy management. This hands-on approach fosters lasting relationships and builds trust.

Key advantages of this approach include:

- Responsive communication channels for quick responses.

- Dedicated agents familiar with individual circumstances.

- Proactive follow-ups to ensure continued satisfaction.

Moreover, the agency provides educational resources to help clients make informed decisions. Regular workshops and informational sessions are designed to enhance understanding of the coverage landscape.

Competitive Pricing

Affordability is another significant factor for many. Ashland Heights offers competitive pricing without compromising on quality. The agency regularly reviews and adjusts options to reflect the best value for clients.

Benefits of competitive pricing include:

- Access to a variety of plans tailored to different budgets.

- Discount opportunities for bundled services.

- Annual reviews to ensure optimal coverage at the best price.

Choosing Ashland Heights means prioritizing personalized care, expert guidance, and cost-effective solutions for all your protection needs.

Comparative Analysis of Local Coverage Providers

Choosing the right provider for additional coverage can significantly impact financial security. Local companies offer various options that cater to the unique needs of residents in the area, making it essential to compare their offerings.

In assessing providers, consider factors such as coverage limits, premiums, customer service, and claims processing efficiency. A thorough evaluation can lead to a decision that best suits individual circumstances.

Key Factors to Consider

- Coverage Limits: Examine the maximum amount each company is willing to cover. This varies widely among providers and can affect your overall protection.

- Premium Rates: Analyze the cost of premiums in relation to the coverage offered. Some companies may provide lower rates but with reduced benefits.

- Customer Service: Research customer reviews and ratings to gauge the level of service each provider offers. Responsive support can be crucial during claims.

- Claims Processing: Investigate the efficiency of claims management. A streamlined process can greatly reduce stress when filing a claim.

| Provider | Coverage Limit | Premium Cost | Customer Rating | Claims Process Time |

|---|---|---|---|---|

| Provider A | $1,000,000 | $$ | 4.5/5 | 5 days |

| Provider B | $2,000,000 | $$$ | 4.0/5 | 7 days |

| Provider C | $1,500,000 | $$$ | 4.8/5 | 3 days |

By carefully weighing these elements, individuals can make informed decisions that align with their protection needs and financial situation. Local providers can offer tailored solutions that resonate with community values and expectations.

Key Factors to Evaluate When Selecting an Agency

Assessing an organization for protection against unforeseen incidents requires careful thought regarding various attributes. Consider the agency’s experience and expertise in the field, as familiarity with specific risks and coverage options can significantly impact the quality of service provided.

Look into the agency’s reputation within the community. Reviews and testimonials from previous clients can offer insights into the level of satisfaction and reliability. An agency known for its transparency and customer care can make a considerable difference in your overall experience.

Experience and Specialization

Investigate the length of time the organization has been operating and whether it specializes in the coverage you need. Agencies with a solid track record often have the necessary skills to navigate complex situations and provide tailored solutions.

Customer Support

Evaluate the level of support offered. Accessible and responsive customer service can alleviate stress during claims or inquiries. Ensure that the agency has multiple channels for communication, such as phone, email, and live chat.

Coverage Options

Examine the variety of plans available. A broader range of options allows for customization to fit personal or business needs. Assess whether the agency can adapt coverage as circumstances change over time.

Financial Stability

Research the financial health of the organization. Reliable companies are less likely to face issues that could affect their ability to honor claims. Look for ratings from independent agencies to gauge stability.

Pricing Structure

Understand the pricing model and any additional fees associated with the policies. A clear and transparent pricing structure will help avoid surprises later on. Comparing quotes from different organizations can also provide a better understanding of the market.

Customer Reviews and Experiences with Local Insurers

Local providers in the Ashland Heights area have garnered mixed feedback from clients regarding their coverage options. Many customers appreciate the personalized service and responsiveness to inquiries, which creates a more comfortable experience when selecting protection plans. For instance, one client highlighted how their agent took the time to understand their specific needs, leading to a tailored policy that offered peace of mind.

However, some reviews suggest that certain insurers may fall short in terms of claims processing efficiency. A few users reported delays and communication issues when trying to resolve their claims, which can be frustrating in times of need. It’s essential for potential clients to weigh these factors carefully before making a decision.

Insights from Customer Experiences

- Positive Interactions: Many clients have praised the local agents for their attentiveness and willingness to explain complex terms. This has led to a sense of trust and confidence among policyholders.

- Claims Process Challenges: Some individuals noted that while getting coverage was straightforward, the claims process could be cumbersome and lacked clarity.

- Pricing Transparency: A number of customers appreciated the clear breakdown of costs, which helped them understand what they were paying for and avoid unexpected fees.

In summary, while local insurers in this region offer commendable customer service and tailored plans, potential clients should be aware of possible delays in claims handling. Balancing these experiences can guide individuals in selecting the right provider that meets their needs.

Steps to Obtain a Quote from Local Providers

Gather essential information about your assets and personal circumstances before reaching out to local providers. This preparation ensures that you receive accurate estimates tailored to your specific needs.

Contact multiple firms to compare options and find the most suitable coverage. A variety of quotes allows for better decision-making in selecting the right policy for your situation.

- Research Local Firms: Identify reputable companies in your area. Look for customer reviews and ratings to assess their reliability.

- Prepare Personal Information: Have details such as your property value, income, and any existing coverage readily available.

- Request Multiple Quotes: Reach out to at least three different providers to obtain a range of offers.

- Understand Coverage Options: Ask detailed questions about what each quote covers and any exclusions.

- Review and Compare: Analyze the quotes side by side, taking note of coverage limits, deductibles, and premiums.

- Inquire About Discounts: Ask if there are any available discounts that could lower your premium.

- Select and Finalize: After careful consideration, choose the option that best meets your needs and complete the application process.

Taking these steps will streamline the process of acquiring a tailored policy suited to your needs. A thorough approach ensures that you secure the most appropriate coverage for your circumstances.

Best umbrella liability insurance agency ashland heights

Features

| Release Date | 2016-06-07T00:00:00.000Z |

| Edition | 2nd |

| Language | English |

| Number Of Pages | 230 |

| Publication Date | 2016-06-07T00:00:00.000Z |

| Format | Kindle eBook |

Features

| Is Adult Product | |

| Language | English |

| Number Of Pages | 206 |

| Publication Date | 2024-03-23T00:00:01Z |

Video:

FAQ:

What are the key benefits of having umbrella liability insurance in Ashland Heights?

Umbrella liability insurance offers several significant benefits. First, it provides additional coverage beyond the limits of your primary insurance policies, such as homeowners or auto insurance. This means that if you face a lawsuit or significant claims that exceed your primary policy limits, the umbrella policy can cover the excess amounts, protecting your assets and savings. Secondly, it can cover claims that may not be included in your other policies, such as slander or false imprisonment. Additionally, umbrella insurance often comes at a relatively low cost compared to the amount of coverage it provides, making it a financially sound choice for individuals looking to safeguard their financial future.

How can I choose the best umbrella liability insurance agency in Ashland Heights?

Choosing the right umbrella liability insurance agency involves several steps. Start by researching local agencies and reading customer reviews to gauge their reputation. Look for agencies that specialize in umbrella insurance, as they will have a better understanding of the nuances of these policies. It’s advisable to obtain quotes from multiple agencies to compare coverage options and pricing. Additionally, check if the agency has a strong customer service record, as good communication is key when you need to file a claim. Finally, consider speaking directly with agents to discuss your specific needs and assess their expertise and willingness to assist you in finding the right policy.

What factors influence the cost of umbrella liability insurance in Ashland Heights?

The cost of umbrella liability insurance can vary based on several factors. One significant factor is the amount of coverage you choose; higher limits will generally result in higher premiums. Your underlying home and auto insurance policies also play a role, as insurers typically require certain minimum coverage limits for these policies before offering an umbrella policy. Additionally, your personal risk profile, including your claims history, the number of assets you need to protect, and your lifestyle choices, can affect your premium. Finally, the specific agency and the discounts they offer may influence the overall cost, so it’s wise to explore different options to find the best deal.