For residents of Rapid Valley, selecting a reliable provider for additional protection against unforeseen events is crucial. This article outlines key factors to consider when seeking comprehensive coverage, ensuring you are well-equipped to handle potential liabilities that may arise.

In this guide, I will highlight the most reputable firms in the area, comparing their offerings, customer service, and overall reputation. Whether you are a homeowner, business owner, or renter, this information will help you make informed decisions tailored to your unique needs.

Expect detailed insights into policy options, pricing structures, and customer reviews. By the end of this article, you will have a clear understanding of the best choices available, enabling you to secure peace of mind for yourself and your loved ones.

Recommended Coverage Provider in the Area

If you seek comprehensive protection against unforeseen incidents, prioritizing local providers can be beneficial. Engaging with a reliable service in your vicinity ensures that your needs are met with personalized attention and tailored solutions.

In this context, considering an establishment known for its solid reputation and client-focused approach is advisable. Such providers typically offer extensive options to cover various risks that may arise in daily life.

Key Factors to Consider

When evaluating potential coverage sources, focus on the following aspects:

- Customer Service: Look for agencies that prioritize client support, ensuring you have assistance when needed.

- Policy Options: A diverse range of plans allows for customization based on individual circumstances.

- Claims Process: Understanding the efficiency of the claims process can save time during stressful situations.

- Reviews and Testimonials: Feedback from current and past clients provides insight into the agency’s reliability.

By assessing these factors, you can make an informed choice that aligns with your specific requirements and preferences.

Client Considerations

Many residents find it beneficial to reach out directly to potential providers for consultations. This direct interaction allows for clarification of coverage details and assurance that the services offered align with individual needs.

- Prepare a list of questions regarding policy specifics.

- Inquire about discounts for bundled services.

- Evaluate the agency’s responsiveness to inquiries.

Utilizing these strategies will enhance your experience and ensure you secure the most suitable protection available in your locality.

Understanding Liability Coverage Basics

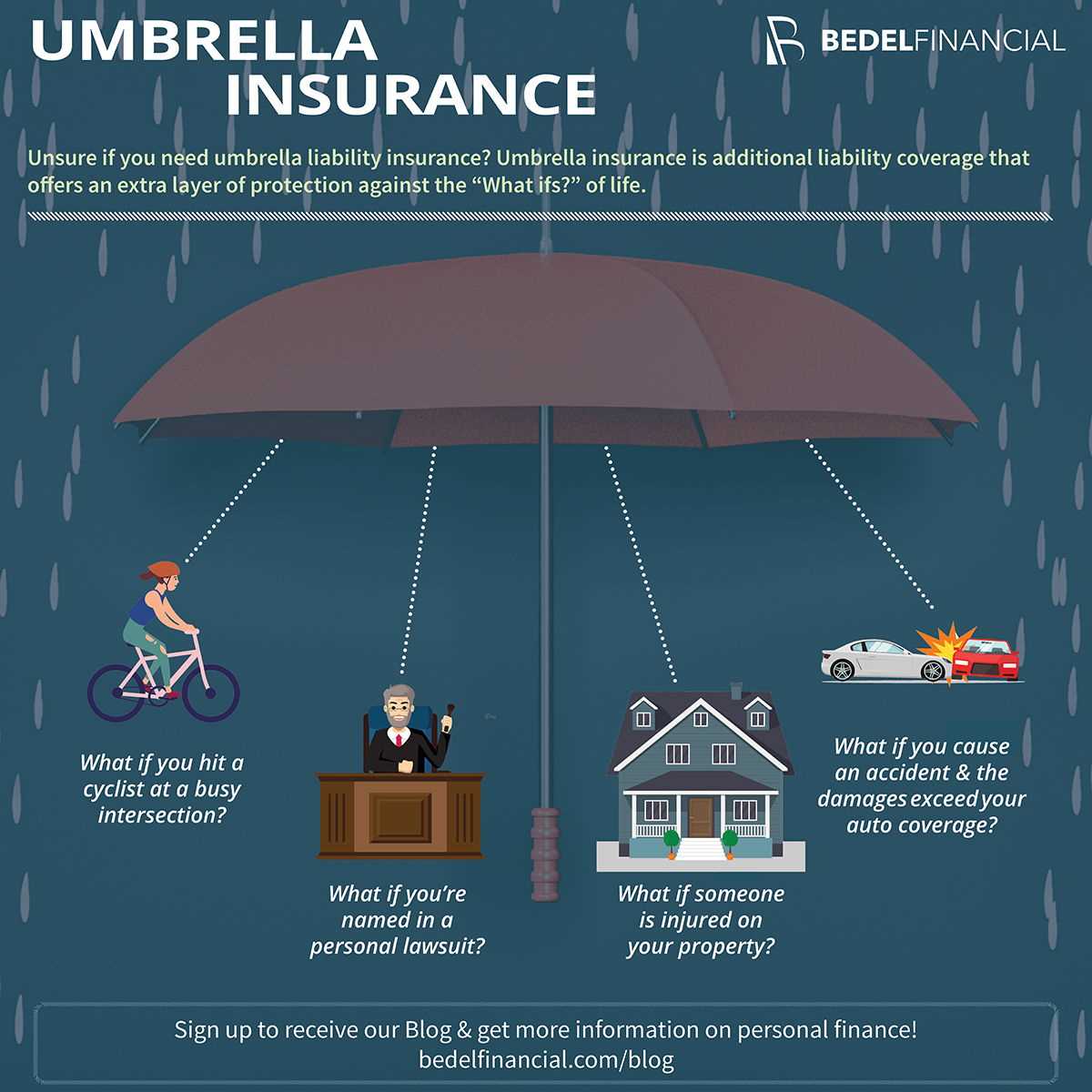

This type of coverage provides an additional layer of protection beyond standard policies, safeguarding against significant claims that could exceed primary coverage limits. It is designed to protect personal assets in the event of a lawsuit or major financial loss due to unexpected incidents.

Individuals should consider this coverage to address gaps in their existing policies, especially in situations where personal responsibility may be questioned. The financial peace of mind it offers can be crucial for those with considerable assets or high-risk lifestyles.

Key Aspects to Consider

Several factors influence the decision to obtain this type of protection:

- Coverage Limits: Assess the amount of additional coverage needed based on personal assets and potential risks.

- Exclusions: Understand what is not covered, as specific incidents may fall outside the policy’s purview.

- Cost: Weigh the premium against the potential financial exposure; often, this coverage is affordable relative to the protection offered.

- Requirements: Some policies may require a minimum level of primary coverage to qualify.

When considering this type of coverage, it is advisable to consult with a knowledgeable expert who can provide tailored advice based on individual circumstances. Comparing multiple options ensures that you secure the most appropriate plan for your needs.

Features to Look for in an Insurance Provider

Reputation and reliability are paramount when selecting a provider for your coverage needs. Seek out a firm with a strong history of client satisfaction and positive testimonials. Researching online reviews and ratings can provide insight into the experiences of other customers, helping you gauge the quality of service offered.

Another aspect to consider is the range of coverage options available. A provider that offers various plans can cater to your specific requirements, ensuring you receive adequate protection tailored to your situation. Look for comprehensive policies that cover multiple scenarios, so you can feel secure in your choice.

Communication and Support

Effective communication is critical in any client-provider relationship. Choose a firm that is accessible and responsive to inquiries, whether through phone, email, or online chat. This ensures that you can get assistance when needed, which can be especially important during a claim process.

Additionally, assess the expertise of the agents. Knowledgeable representatives can help clarify policy details, offer guidance on coverage selection, and assist with claims. A provider with well-trained staff can make a significant difference in your overall experience.

Pricing and Discounts

Comparing pricing structures is essential. Look for transparent pricing without hidden fees. Some firms provide discounts for bundling multiple policies or maintaining a claim-free record. Understanding the pricing model can help you find a balance between cost and coverage.

In summary, prioritize providers with strong reputations, diverse coverage options, effective communication, knowledgeable staff, and transparent pricing. These factors will aid in securing the right protection for your needs.

Comparing Local Agencies in Rapid Valley

To find the right provider for additional coverage, evaluate local options in the area. Each firm offers unique advantages that can cater to different needs, making it crucial to assess their specific offerings and customer service quality.

Consider factors such as policy customization, client support, and pricing structures. Engaging with agencies directly can provide insights into their willingness to adapt to individual requirements, which is often a key differentiator.

Evaluating Key Aspects

- Personalization: Look for companies that allow tailoring of coverage plans. This flexibility can significantly impact your overall protection.

- Client Reviews: Research feedback from existing customers. Their experiences can highlight strengths or weaknesses in service and support.

- Accessibility: Assess how easy it is to communicate with representatives. Quick responses can be critical during urgent situations.

- Local Expertise: Agencies with a deep understanding of regional laws and risks may offer more relevant advice and tailored solutions.

Comparative analysis can also involve financial stability metrics of each provider. Companies with robust financial health typically ensure reliability in claims handling.

| Agency | Personalization | Client Feedback | Response Time |

|---|---|---|---|

| Agency A | High | Positive | Fast |

| Agency B | Medium | Mixed | Moderate |

| Agency C | High | Very Positive | Very Fast |

By carefully analyzing these elements, you can make an informed decision that aligns with your specific requirements. Engaging with multiple firms for quotes can further clarify your options and aid in selecting the most suitable provider.

Customer Reviews: Insights on Agency Performance

Clients frequently highlight the responsiveness of the representatives as a significant strength of the firm. The ability to quickly address inquiries and concerns builds trust and enhances the overall experience. Many reviews commend the knowledgeable staff for providing clear explanations of policies, making the decision-making process smoother.

Another common point of praise is the competitive pricing structure. Several customers note that the value provided exceeds their expectations, especially when compared to other providers. This favorable perception often leads to long-term relationships, as clients appreciate both the financial benefits and the personalized service they receive.

Key Takeaways from Customer Feedback

- Responsiveness: Timely communication is a consistent theme in reviews.

- Expert Guidance: Clients appreciate the thorough explanations and guidance through the policy details.

- Competitive Pricing: Many find the pricing to be fair and reflective of the service quality.

Furthermore, some clients mention the ease of the claims process as a highlight. When incidents occur, having a streamlined method to file claims is invaluable. This efficiency contributes to overall satisfaction and loyalty.

In conclusion, customer insights reveal a strong emphasis on service quality, pricing, and claims handling. These factors play a crucial role in shaping the reputation of the firm within the community.

Cost Factors Affecting Umbrella Liability Policies

Understanding the expenses associated with excess coverage can help individuals and businesses make informed decisions. Several key elements contribute to the overall cost of these policies.

One significant factor is the underlying coverage limits of existing policies. Higher limits on primary coverage can lead to increased costs for additional protection, as the insurer’s risk is influenced by the extent of the primary coverage.

Key Cost Determinants

Several aspects influence the premium rates for excess coverage:

- Claims History: A history of frequent claims can drive costs up, as insurers view this as a higher risk.

- Coverage Amount: The greater the amount of additional protection desired, the higher the premium will likely be.

- Location: Geographic factors can affect risk assessments; areas with higher crime rates or natural disasters may incur higher costs.

- Personal or Business Activities: Engaging in high-risk activities, whether personal or professional, influences the overall cost.

- Credit Score: Insurers may consider an applicant’s credit score, linking lower scores with higher risk, which can increase premiums.

In conclusion, evaluating these factors can provide a clearer picture of expected costs. By addressing each aspect, individuals and businesses can better manage their expenses related to excess coverage.

Common Coverage Exclusions to Be Aware Of

Understanding the exclusions in your coverage is essential to avoid unexpected financial burdens. Many policies contain specific limitations that can leave individuals vulnerable in certain scenarios.

Common exclusions often include claims arising from intentional acts, contractual liabilities, and certain types of damages. Being aware of these limitations can help individuals make informed decisions about their coverage needs.

Key Exclusions

- Intentional Acts: Claims resulting from deliberate actions are generally not covered. This includes any damage or injury caused by willful misconduct.

- Contractual Liabilities: Obligations from contracts that impose liability, unless specifically included in the policy, may not be covered. This is particularly relevant for businesses.

- Property Damage: Damage to your own property is typically excluded. This means any repairs or replacements needed after an incident may come out of pocket.

- Business Activities: Injuries or damages occurring during business operations are often not included in personal coverage, necessitating separate protection.

- Automobile Incidents: Most policies do not cover accidents involving vehicles. Separate auto coverage is usually required to handle these claims.

Reviewing your policy with a knowledgeable representative can clarify these exclusions and help you assess whether additional coverage is necessary for your circumstances.

Steps to Secure the Best Policy for Your Needs

Identify your specific requirements. Assess your assets, income, and potential risks to determine the level of coverage you need. This foundational step will guide your selection process and help narrow down the options available.

Research various providers in your area. Compare their offerings, customer reviews, and financial stability. This will ensure you choose a reliable company that meets your coverage needs effectively.

Key Steps to Follow

- Gather Quotes: Request quotes from multiple providers to compare pricing and coverage options.

- Understand Policy Terms: Read the fine print to comprehend exclusions, limitations, and conditions associated with each policy.

- Consult an Expert: Speak with an agent or broker for tailored advice based on your unique situation.

- Evaluate Discounts: Inquire about available discounts for bundling policies or maintaining a claims-free record.

- Review and Decide: Analyze all gathered information and choose the policy that best aligns with your needs and budget.

Following these steps will enhance your chances of securing a policy that provides adequate protection tailored to your individual circumstances. Taking the time to research and evaluate options is essential for making a sound decision.

Best umbrella liability insurance agency rapid valley

Features

| Release Date | 2016-06-07T00:00:00.000Z |

| Edition | 2nd |

| Language | English |

| Number Of Pages | 230 |

| Publication Date | 2016-06-07T00:00:00.000Z |

| Format | Kindle eBook |

Features

| Edition | 9 |

| Language | English |

| Number Of Pages | 400 |

| Publication Date | 2011-09-30T00:00:01Z |

Video:

FAQ:

What factors should I consider when choosing an umbrella liability insurance agency in Rapid Valley?

When selecting an umbrella liability insurance agency in Rapid Valley, several factors are important to consider. First, look into the agency’s reputation and customer reviews. This can provide insight into their reliability and the quality of their service. Next, consider the coverage options they offer. It’s crucial to ensure that the policy meets your specific needs and includes adequate limits. Additionally, evaluate the agency’s experience in the field and their knowledge of local laws and regulations, as this can affect the policy’s effectiveness. Lastly, compare pricing among different agencies to find a balance between affordability and comprehensive coverage.

How does umbrella liability insurance work, and why might I need it in Rapid Valley?

Umbrella liability insurance provides additional coverage beyond the limits of your primary insurance policies, such as homeowners or auto insurance. It acts as a safety net, protecting your assets in the event of significant claims or lawsuits. In Rapid Valley, this type of insurance can be particularly beneficial due to the potential for unforeseen incidents, such as accidents on your property or in your vehicle that exceed your existing policy limits. It helps cover legal fees, medical costs, and damages that may arise from such incidents, ensuring that you are not financially devastated by an unexpected event. Given the unpredictable nature of life, having this extra layer of protection can offer peace of mind.