If you’re seeking to enhance your financial safety net, consider adding extra liability protection. This article outlines the key aspects of additional liability coverage, including what it typically includes, how it functions, and who can benefit from it. You’ll discover practical insights into how this type of protection can safeguard your assets and provide peace of mind.

This information is particularly valuable for homeowners, renters, and individuals with significant assets. Understanding the nuances of this coverage can help you make informed decisions about your insurance needs, ensuring that you’re adequately protected against unforeseen events that could lead to substantial financial loss.

In this article, you’ll find a breakdown of common scenarios where additional liability coverage proves beneficial, tips for assessing your current insurance options, and guidance on how to choose the right level of protection for your unique situation. By the end, you’ll have a clearer understanding of how to effectively shield yourself from unexpected liabilities and enhance your overall financial security.

Best Umbrella Policy Coverage

For individuals seeking to enhance their liability protection, selecting the right supplementary coverage is paramount. This type of insurance serves as an additional layer that extends beyond standard limits of existing policies, such as homeowners or auto insurance.

When evaluating options, consider the degree of protection needed based on personal circumstances. Factors such as assets, income, and lifestyle play a significant role in determining suitable coverage limits. A thorough assessment can safeguard against potential lawsuits or significant claims, ensuring peace of mind.

Key Aspects to Evaluate

- Coverage Limits: Aim for limits that adequately protect your assets. Many experts suggest a minimum of one million dollars as a starting point, but higher limits may be advisable based on individual risk assessment.

- Exclusions: Review any exclusions carefully. Certain situations, such as professional liabilities or intentional acts, may not be covered. Understanding these limitations is vital to avoid surprises during a claim.

- Premium Costs: Compare premiums across different insurers. While higher coverage often results in increased costs, it’s essential to find a balance between adequate protection and affordability.

- Underlying Policies: Ensure that the primary policies are in force, as supplementary coverage typically requires active underlying insurance to be valid.

Moreover, keep in mind the geographical considerations. Some regions may have higher risks associated with specific liabilities, such as natural disasters or higher rates of accidents. Tailoring coverage to fit these nuances can enhance protection further.

Engaging with an insurance professional can provide personalized insights, ensuring that the chosen option aligns with both current needs and future aspirations. This approach not only enhances security but also fosters financial stability.

Understanding Umbrella Insurance Essentials

Having additional liability insurance is a significant step for safeguarding personal assets. This form of protection extends beyond standard coverage, offering financial security in various situations that may lead to substantial claims.

Essentially, this insurance can cover various incidents, including bodily injury, property damage, and certain lawsuits. It is designed to provide an extra layer of security, ensuring that individuals are not left financially vulnerable due to unforeseen events.

Key Features of Additional Liability Insurance

The following points highlight the main advantages of acquiring this type of insurance:

- Extended Limits: It typically offers higher limits than standard liability insurance, which can protect assets in case of serious claims.

- Broader Coverage: This coverage may include incidents not covered by standard policies, such as slander or libel.

- Cost-Effective: Generally, the premium for this additional protection is relatively low compared to the coverage it provides.

Individuals should evaluate their personal and financial situations to determine the appropriate level of coverage needed. Factors such as income, assets, and lifestyle should influence the decision-making process.

Factors to Consider

When assessing the necessity for this type of insurance, consider the following:

- Your Net Worth: The higher your assets, the more protection you may require.

- Risk Exposure: Analyze your daily activities that might increase liability risk, such as owning a pool or hosting frequent gatherings.

- Current Coverage: Review existing policies to identify gaps where additional coverage might be beneficial.

Investing in such protection can prevent financial disaster and ensure peace of mind. A thorough assessment of personal circumstances will help in making an informed decision regarding the level of protection needed.

Key Benefits of Adding an Umbrella Policy

Enhancing your existing insurance arrangements with an additional layer of protection can offer significant peace of mind. This supplementary coverage acts as a safety net, providing financial support beyond standard limits, which can be crucial in unforeseen situations.

One of the primary advantages is the increased liability limits that come with this additional protection. In the event of a serious incident, such as an accident or property damage, the financial repercussions can be substantial. Having this extra coverage ensures that you are not left vulnerable to high out-of-pocket expenses or potential lawsuits.

Financial Security

With the rising costs associated with legal fees and settlements, the financial security provided by an expanded coverage framework becomes increasingly valuable. It protects your assets, including savings and property, from being depleted due to unexpected claims.

Moreover, this type of coverage typically extends to various scenarios, including personal injury, property damage, and even certain claims that may arise from social media activities. This broad range of protection means you can navigate daily life with greater confidence, knowing you have a financial buffer in place.

Affordability

Adding this type of coverage is often more affordable than one might expect. Considering the extensive protection it offers, the cost is relatively low compared to the potential financial losses you might face without it. This makes it a practical choice for individuals looking to enhance their risk management strategy.

In conclusion, incorporating this additional layer of security into your insurance plan can provide significant benefits. From increased liability limits to financial protection against unforeseen events, the advantages far outweigh the costs, making it a wise investment for long-term peace of mind.

Determining the Right Coverage Amount for You

Assess your assets and potential liabilities to establish an appropriate amount of protection. A common recommendation is to have a limit that exceeds your total net worth, ensuring that all personal and financial resources are adequately safeguarded against unforeseen events.

Consider your lifestyle, including any activities that might expose you to higher risks, such as owning rental properties or engaging in public-facing professions. Each of these factors can significantly influence the level of protection you may require.

Factors to Evaluate

- Net Worth: Calculate your total assets, including savings, property, and investments, and subtract any liabilities.

- Potential Legal Costs: Understand the average costs associated with legal defense in your area, as these can vary widely.

- Income Considerations: If you have a high income or are in a profession with a greater risk of lawsuits, higher limits are advisable.

- Family Considerations: If you have dependents, consider how much financial support they would need in case of an incident.

Regularly review and adjust your coverage to reflect changes in your financial situation, lifestyle, or assets. An annual assessment can help ensure that your protection remains adequate as your circumstances evolve.

| Scenario | Recommended Coverage Amount |

|---|---|

| Young Professional | $1 million |

| Homeowner with Rental Property | $2 million |

| Business Owner | $5 million |

By evaluating these aspects, you can tailor your protection to fit your unique needs, ensuring peace of mind in the face of unexpected events.

Common Exclusions in Umbrella Coverage

Understanding the limitations of liability supplements is critical for comprehensive financial protection. Many individuals overlook specific exclusions that can significantly impact their security in case of unforeseen events. Awareness of these exclusions can prevent potential gaps in coverage that might leave policyholders vulnerable.

Common exclusions often include certain liabilities that are not covered, which can vary between providers. It is essential to review these exclusions closely to ensure that you have the necessary protections in place. Below are some frequently seen exceptions:

Exclusions to Consider

- Intentional Acts: Any damages or injuries resulting from deliberate actions are typically not covered.

- Business Activities: Liability arising from business operations or professional services is usually excluded.

- Auto-Related Claims: Incidents involving vehicles often fall outside the scope of these additional protections.

- Property Damage: Damage to your own property is generally not included in the coverage.

- Contractual Liability: Obligations assumed under contracts may not be covered unless specifically included in the terms.

Reviewing exclusions is vital to ensure that your financial security aligns with your personal and professional circumstances. Consulting with an insurance advisor can provide clarity on how these exclusions might affect your overall financial strategy.

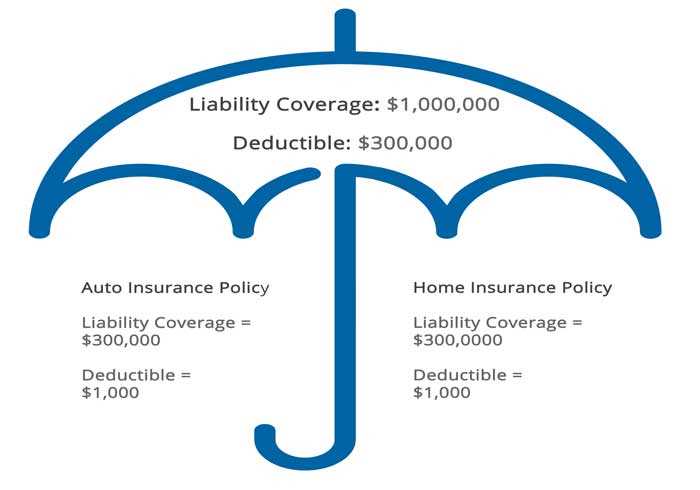

How Excess Liability Insurance Works with Existing Plans

Excess liability insurance provides additional financial protection beyond the limits of existing coverage types, such as homeowners or auto insurance. This type of protection kicks in when the primary policies have reached their maximum payout, ensuring that you remain safeguarded against significant financial loss in the event of a claim.

This insurance typically covers a broad range of incidents, including personal injury, property damage, and legal costs. It acts as a safety net, stepping in when the limits of your base coverage are exhausted, allowing you to avoid potential out-of-pocket expenses that could be financially devastating.

Integration with Existing Coverage

To fully understand how this additional protection functions, consider the following key points:

- Supplementary Role: It enhances existing policies, ensuring that you have access to greater limits in case of severe claims.

- Claim Process: In the event of a lawsuit or claim exceeding the primary limit, your existing insurance will pay up to its limit first. Once that limit is reached, the excess liability coverage will take over, covering the remaining costs.

- Policy Requirements: Most insurers require you to carry certain minimum limits on your primary policies before you can obtain additional protection. This ensures that your foundational coverage is adequate.

In essence, having this extra layer of protection allows for peace of mind, knowing that substantial claims will not lead to financial hardship. It is a prudent choice for individuals with significant assets or those who wish to safeguard their financial future against unforeseen incidents.

Conclusion on Factors Influencing the Cost of Excess Liability Protection

The cost of additional protection is shaped by multiple elements that potential policyholders should assess. Understanding these factors can lead to more informed decisions and potentially lower premiums.

Key influences on the pricing include the insured individual’s risk profile, the extent of underlying coverage, geographical location, and any prior claims history. Each of these aspects can significantly impact the final cost of additional liability insurance.

Key Factors to Consider

- Risk Profile: Individuals with higher perceived risks, such as those with a history of claims or high-value assets, may face increased costs.

- Underlying Coverage: The amount of existing liability protection affects pricing; higher limits in primary policies can sometimes lead to lower excess premiums.

- Geographical Location: Areas with higher crime rates or natural disaster risks may lead to elevated premiums.

- Claims History: A record of past claims can signal higher future risks, influencing costs.

By taking these elements into account, individuals can better navigate their options and choose the most suitable form of enhanced liability protection for their needs.

Best umbrella policy coverage

Features

| Is Adult Product | |

| Edition | 3 |

| Language | English |

| Number Of Pages | 800 |

| Publication Date | 2015-02-24T00:00:01Z |

Features

| Release Date | 2018-04-09T00:00:00.000Z |

| Edition | 2 |

| Language | English |

| Number Of Pages | 577 |

| Publication Date | 2018-02-19T00:00:00.000Z |

| Format | Kindle eBook |

Video:

FAQ:

What is an umbrella policy and what coverage does it typically provide?

An umbrella policy is a type of insurance that offers additional liability coverage beyond the limits of your other insurance policies, such as auto or homeowners insurance. It is designed to protect you from major claims and lawsuits, providing financial security in the event of significant liabilities. Typically, it covers personal injury claims, property damage, and certain legal fees. For example, if you are found liable for an accident that exceeds your auto policy limit, your umbrella policy can help cover the remaining costs. Additionally, it may cover claims related to libel, slander, and certain rental property liabilities, offering a broader safety net against unexpected financial burdens.

How do I determine the right amount of coverage for my umbrella policy?

Determining the right amount of coverage for your umbrella policy involves assessing your personal assets, potential risks, and lifestyle. A common recommendation is to have coverage that is at least equal to your net worth, as this ensures that your assets are protected in case of a lawsuit. For instance, if your assets total $1 million, you might consider a $1 million umbrella policy. Additionally, consider your occupation, hobbies, and any other activities that could increase your liability risk. Consulting with an insurance agent can also provide valuable insights tailored to your unique situation, helping you choose a coverage amount that fits your needs without leaving you exposed to significant financial risk.