Consider seeking additional coverage to protect your assets beyond standard policies. This article outlines the steps to secure supplementary liability protection, ensuring you have adequate financial safety nets for unforeseen events.

This guide is tailored for homeowners, renters, and vehicle owners who wish to enhance their insurance plans. It provides practical advice on evaluating your current coverage, assessing your risk exposure, and finding the right carrier to meet your needs.

In the following sections, I’ll cover key aspects such as understanding the benefits of extended coverage, comparing different providers, and tips for obtaining the most favorable terms. By the end, you’ll have a clear path to reinforcing your financial security against potential lawsuits or claims.

Best Way to Purchase an Umbrella Coverage

Researching multiple insurance providers is critical to securing comprehensive protection. Start by examining the financial stability and customer reviews of various companies. This ensures that you choose a reliable insurer that can meet your needs effectively.

Gather quotes from different firms, but be cautious of low premiums. Ensure that the coverage limits align with your assets and potential risks. Seek clarity on exclusions, as understanding what is not covered is just as important as knowing what is.

Factors to Consider

- Coverage Limits: Determine how much additional liability protection you require beyond your existing policies.

- Premium Costs: Compare the costs relative to the coverage offered, avoiding policies that seem too inexpensive.

- Bundling Options: Inquire if the insurer provides discounts for bundling with other insurance products.

- Claims Process: Research the claims process to ensure it is straightforward and efficient.

Lastly, consulting with a knowledgeable insurance agent can provide insights tailored to your specific circumstances. They can help clarify the nuances of various options and assist in selecting the most suitable coverage for your lifestyle and assets.

Understanding Umbrella Insurance Coverage

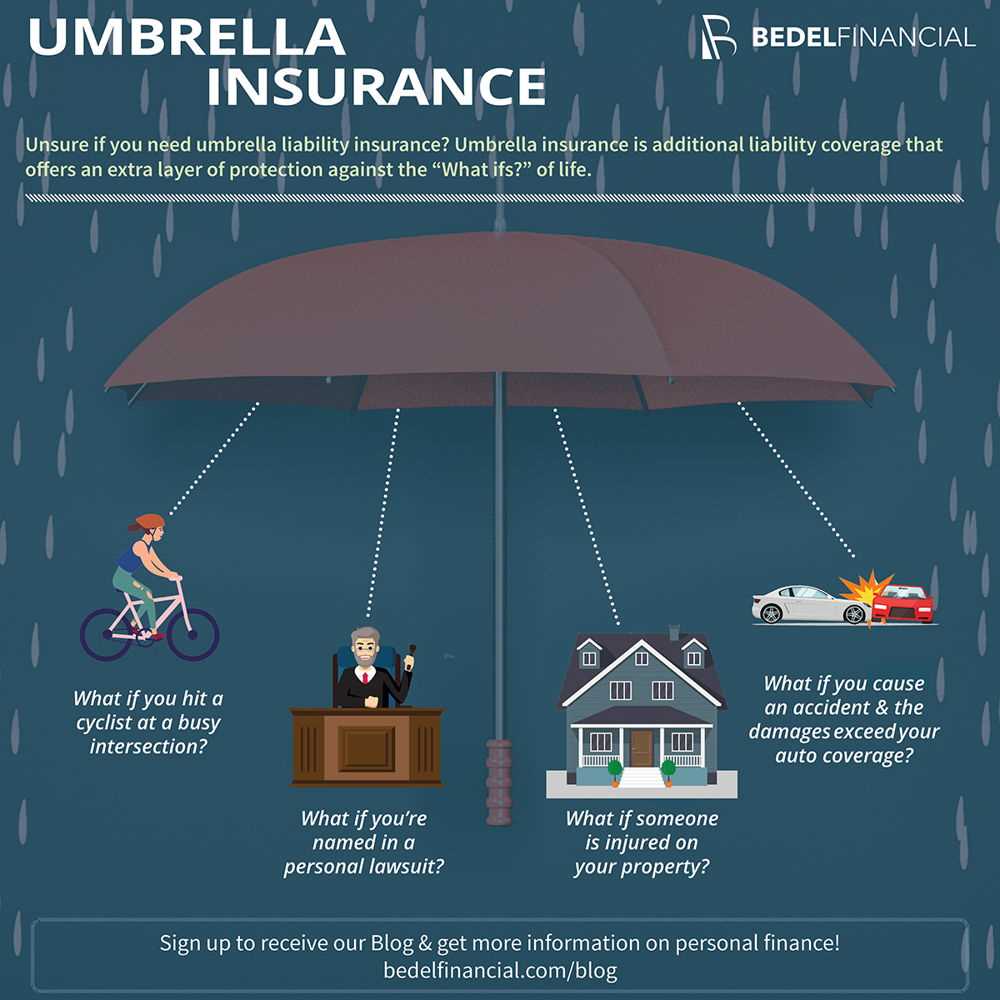

Comprehending the nature of this additional coverage is fundamental. It acts as an extension to existing liability limits, providing an extra layer of protection against significant claims that could exceed standard coverage amounts.

Typical scenarios where such protection is beneficial include severe accidents, lawsuits, or claims resulting from personal injury. This type of insurance can cover legal fees, damages awarded in a lawsuit, and other related expenses, significantly mitigating financial risk.

Key Aspects of Coverage

There are several critical features to consider:

- Liability Limits: This coverage typically kicks in once the limits of your primary insurance, such as home or auto, have been exhausted.

- Worldwide Coverage: Many options provide protection for incidents occurring outside the United States, making it suitable for travelers.

- Broader Scope: It often covers various scenarios not included in standard policies, such as slander or libel.

It’s advisable to assess personal assets and potential risks to determine the necessary amount of coverage. Consulting with an insurance professional can provide tailored insights based on individual circumstances.

Additionally, reviewing the exclusions is vital. Coverage may not apply in specific situations such as business-related liabilities or certain intentional acts. Understanding these limitations will help in making informed decisions about acquiring this form of insurance.

Assessing Your Personal Liability Needs

Understanding your personal liability requirements is fundamental for securing adequate protection against unforeseen incidents. Begin by evaluating your current assets, including property, savings, and investments. This assessment will help in determining the amount of coverage necessary to safeguard your financial well-being.

Consider your lifestyle and the associated risks. If you frequently host gatherings or participate in activities that may lead to accidents, you may need higher levels of protection. Analyzing your potential exposure will provide clarity on the extent of coverage required.

Factors to Consider

- Home Ownership: Owning a home can increase your liability risk, especially if someone gets injured on your property.

- Occupational Hazards: Certain professions carry higher liability risks; assess how your job might impact your insurance needs.

- Family Size: More family members, especially children, can increase the likelihood of accidents, necessitating more coverage.

- Assets: Higher net worth typically requires more extensive protection to cover potential legal claims.

Engaging with a knowledgeable insurance agent can provide tailored insights into your specific situation. They can assist in evaluating risks and help identify the appropriate level of coverage. Additionally, reviewing your coverage periodically ensures that it aligns with any changes in your life circumstances.

Comparing Quotes from Different Providers

Obtaining multiple quotes from various insurers is a critical step in ensuring that you secure a robust supplementary coverage option. Doing so allows you to assess the differences in coverage limits, exclusions, and premium costs, which can vary significantly from one company to another.

Begin by gathering quotes from at least three to five different insurance providers. Ensure that each quote reflects similar coverage terms to facilitate an accurate comparison. You can request these quotes online, over the phone, or through an insurance broker who can assist in finding suitable options tailored to your needs.

Factors to Consider in Your Comparison

- Coverage Limits: Review how much additional financial protection each option offers. Look for limits that adequately cover your assets.

- Exclusions: Understand what is not covered by the policy. Some insurers may have unique exclusions that could impact your decision.

- Premium Costs: Compare the premiums, but don’t choose solely based on the lowest price. Weigh the cost against the coverage provided.

- Claims Process: Research the reputation of each provider regarding their claims handling. A smoother claims process can save time and stress.

- Customer Reviews: Evaluate customer feedback and ratings for each insurer. This can provide insights into their service quality and reliability.

By systematically comparing these elements, you can make a more informed decision. This process not only highlights the financial implications but also the overall value of the coverage options available to you.

Consider using a comparison tool or spreadsheet to track the details of each quote. This approach will help you visualize differences and identify which option aligns best with your requirements.

Evaluating Policy Limits and Exclusions

When assessing coverage options, it’s essential to examine the limits associated with various insurance contracts. These limits define the maximum amount an insurer will pay for a covered loss. Understanding the implications of these limits can prevent financial strain in the event of a significant claim. A thorough evaluation should include a comparison of coverage amounts across different plans to ensure adequate protection against potential liabilities.

In addition to limits, reviewing exclusions is critical. Exclusions outline specific situations or events that are not covered, which can significantly impact the effectiveness of the insurance. It’s advisable to read these sections carefully, as they can vary widely among different insurers. Identifying gaps in coverage can help you make informed decisions about additional policies or endorsements to fill those voids.

Key Factors to Consider

- Coverage Limits: Ensure that the limits align with your assets and potential risk exposure.

- Exclusion Clauses: Pay attention to what is not covered to avoid surprises during claims.

- Additional Coverage Options: Explore endorsements that can expand your protection beyond standard exclusions.

- Comparative Analysis: Compare similar offerings from different insurers to identify the most comprehensive coverage.

Understanding how limits and exclusions interact will empower you to make strategic choices regarding your insurance needs. Consider consulting with an expert to clarify complex language and to explore tailored solutions that suit your circumstances.

Bundling with Existing Insurance Policies

Combining various insurance products with a single provider can lead to significant savings and enhanced coverage. Many insurers offer discounts for customers who opt for multiple types of coverage, making it an attractive option for those seeking additional liability protection.

When considering this approach, it is essential to review your current insurance arrangements. Examine existing homeowners, auto, or renters insurance to determine if your provider offers an additional layer of protection that complements your existing coverage.

Benefits of Bundling

There are several advantages to consolidating insurance plans:

- Cost Savings: Insurers often provide lower premiums when multiple policies are held together.

- Simplified Management: One provider means fewer bills and easier tracking of payments and coverage dates.

- Streamlined Claims Process: A single point of contact can simplify the process when filing a claim.

Before making a decision, evaluate the specifics of the coverage offered. Ensure that the additional protection meets your needs and doesn’t leave gaps compared to standalone options. Consulting with an insurance agent can provide personalized insights tailored to your situation.

Consulting with an Insurance Professional

Engaging with an insurance expert can significantly enhance your understanding of liability coverage options. These specialists possess in-depth knowledge about various types of extended liability protections that can complement your existing coverage.

Insurance professionals can assess your unique situation and help identify gaps in your current coverage. Their expertise allows them to recommend tailored solutions that suit your specific needs.

Benefits of Professional Consultation

- Personalized Advice: Experts analyze your risks and recommend appropriate coverage amounts.

- Market Insights: They are aware of the latest trends and can guide you towards competitive rates.

- Claims Support: Insurance agents can assist in the claims process, ensuring you receive what you’re entitled to.

It’s advisable to prepare a list of questions before your meeting. Consider asking about:

- Different coverage limits available.

- Exclusions or limitations within the coverage.

- How to bundle policies for potential savings.

Building a relationship with an insurance consultant can lead to long-term benefits, including regular policy reviews to adapt to your changing circumstances.

Reviewing and Adjusting Your Coverage Regularly

Regular evaluations of your additional liability coverage are essential. Changes in your personal circumstances or financial situation can significantly impact your needs. Conduct a thorough review at least once a year or after major life events, such as purchasing property, getting married, or starting a business.

Assess your existing limits and consider whether they adequately protect your assets. Consult with your insurance agent to discuss any adjustments based on your current lifestyle and financial goals.

Key Steps to Review and Adjust Your Coverage

- Analyze recent changes in your assets, such as new vehicles, homes, or investments.

- Evaluate your risk factors, including lifestyle changes or increased public exposure.

- Compare your current limits with industry standards to ensure adequate protection.

- Discuss any concerns or questions with your insurance provider for tailored advice.

Regular reviews not only ensure appropriate coverage but can also identify potential savings. Adjusting your coverage as needed protects your financial future more effectively.

Best way to buy umbrella policy

Features

| Is Adult Product | |

| Edition | 3 |

| Language | English |

| Number Of Pages | 800 |

| Publication Date | 2015-02-24T00:00:01Z |

Video:

FAQ:

What is an umbrella policy and why might I need one?

An umbrella policy is a type of insurance that provides additional liability coverage beyond what your standard policies, like auto or homeowners insurance, offer. It’s designed to protect your assets in case of unexpected events, such as a lawsuit. For example, if you’re involved in a car accident and the damages exceed your auto policy limits, an umbrella policy can cover the excess amount. This can be particularly important for individuals with significant assets or those who engage in activities that pose higher risks, as it helps shield your financial future from unforeseen liabilities.

How do I determine how much coverage I need for my umbrella policy?

To determine the appropriate coverage for your umbrella policy, consider your total assets, including savings, investments, and properties. A common rule of thumb is to have coverage that is at least equal to your net worth. Additionally, think about your lifestyle and activities that might increase your risk of liability, such as owning a pool or engaging in sports. Consulting with an insurance agent can also help you assess your needs based on your personal situation and provide guidance on appropriate coverage amounts.

Where is the best place to purchase an umbrella policy?

The best place to purchase an umbrella policy is typically through a well-established insurance company or broker that offers multiple insurance products. You can start by checking with your current insurance provider, as they may offer discounts if you bundle policies. Additionally, it’s wise to compare quotes from different insurers to find the best rates and coverage options. Online resources and insurance comparison websites can provide insights into various policies, helping you make an informed decision. Always read the policy details carefully and ask questions about anything unclear before finalizing your purchase.